Food And Beverages Market Definition

Food and beverages refer to substances consumed by individuals to provide essential nutrients and hydration. Food includes solid items like fruits, vegetables, grains and proteins, which supply energy and support bodily functions. Beverages, on the other hand, are liquids such as water, juice and tea, and others which help maintain hydration and sometimes offer additional nutrients.

The food and beverages (F&B) market consists of sales of food, beverages, animal and pet food and tobacco products by entities (organizations, sole traders and partnerships) that produce beverages, food, animal and pet food and tobacco products. The companies in the food and beverages industry process raw materials into food, animal and pet food and tobacco products, package and distribute them through various distribution channels to both individual customers and commercial establishments.

All citations copied!

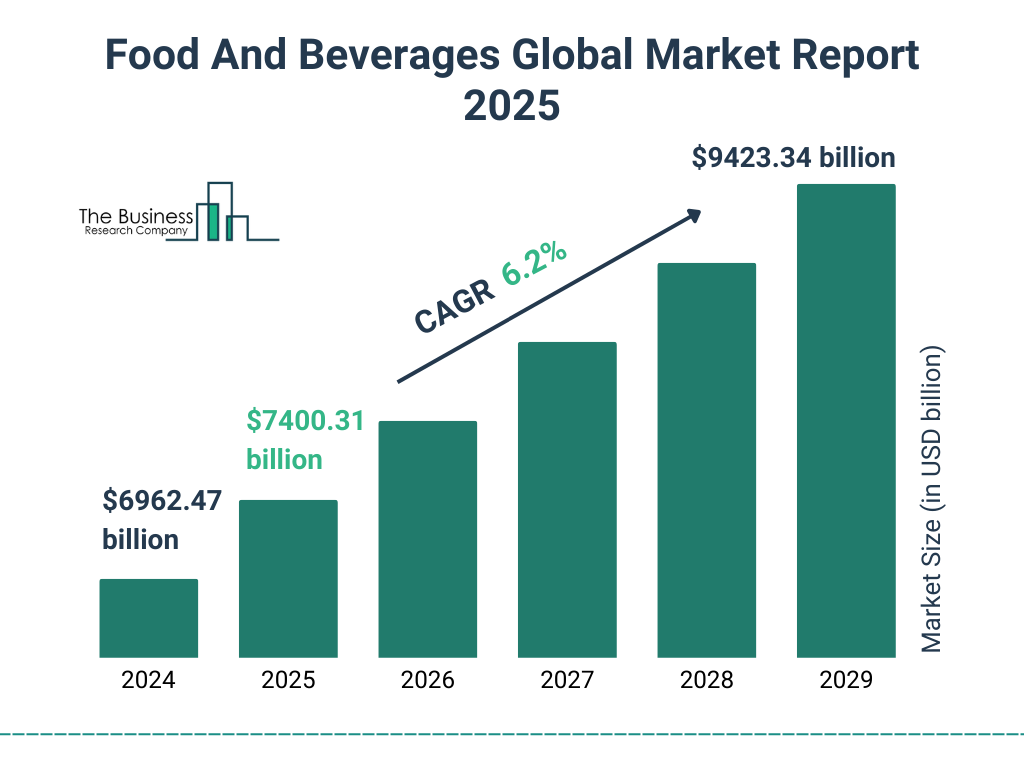

Food And Beverages Market Size

The global food and beverages market reached a value of nearly $6,687.73 billion in 2024, having grown at a compound annual growth rate (CAGR) of 5.41% since 2019. The market is expected to grow from $6,687.73 billion in 2024 to $8,873.58 billion in 2029 at a rate of 5.82%. The market is then expected to grow at a CAGR of 5.54% from 2029 and reach $11,617.75 billion in 2034.

Growth in the historic period resulted from the increasing demand for ready-to-eat food, increasing health consciousness, rising e-commerce and online food delivery and growing consumer preference for organic products. Factors that negatively affected growth in the historic period were fluctuating raw material prices and legal actions against misinformation and false advertising.

Going forward, the increasing focus on sustainability and ethical practices, the rising interest in plant-based foods, biodegradable and eco-friendly packaging and expansion of alternative protein option will drive the growth. Factor that could hinder the growth of the food and beverages market in the future include stringent regulations and bans and climate change and global warming.

Food And Beverages Market Drivers

The key drivers of the food and beverages market include:

Expansion Of Alternative Protein Option

During the forecast period, the expansion of alternative protein options will propel the growth of the food and beverages market. The growth of alternative protein options is driving significant advancements within the food and beverage industry by addressing the increasing demand for sustainable, plant-based, and lab-grown protein sources. This transition promotes a more environmentally sustainable food system by reducing dependency on traditional animal agriculture. Additionally, it aligns with the evolving dietary preferences of consumers seeking healthier, cruelty-free, and allergen-friendly alternatives, fostering innovation and expanding opportunities for a wider range of food products. For instance, according to Source Advisors Ltd., a UK-based company specializing in R&D tax relief and innovation services, by 2040 cultured meat is expected to make up 35% of global meat consumption, rising from 10% in 2025. Therefore, the expansion of alternative protein options is expected to drive the growth of the food and beverages market.

Food And Beverages Market Restraints

The key restraints on the food and beverages market include:

Stringent Regulations And Bans

Stringent regulations limited the growth of the food and beverages market during the historic period. Food and beverages manufacturers must adhere to certain standards and regulations implemented by governments. Globally, several countries imposed regulations on ingredients used in products, and labeling of products. For instance, in the USA, an ingredient is not allowed to be used in pet food until it has been accepted by the Food and Drug Administration (FDA) and adopted by the Association of American Feed Officials (AAFCO). Besides, governments in a few countries banned certain types of foods with the aim of improving the overall health of their citizens. Also, in 2021, FSSAI (Food Safety and Standards Authority of India) came up with a regulation prescribing the labeling requirements of pre-packaged foods and display of vital information on where food is manufactured, processed, stored and served. Stringent regulations restrained the growth of the food and beverages market.

Food And Beverages Market Trends

Major trends shaping the food and beverages market include:

Introducing New Andouille Smoked Sausage With Bold New Flavor

Companies operating in the food and beverages market are focusing on new Andouille smoked sausage with New Orleans flavor. The product demonstrates versatility, complementing New Orleans classics such as gumbo and jambalaya, as well as other offerings like charcuterie boards. This provides consumers with a convenient solution for incorporating authentic, flavorful sausage into a wide range of meal preparations. For instance, in December 2024, Zatarain's, a US-based food and spice company, launched reformulated Andouille Smoked Sausage. It introduces a bold, New Orleans-inspired flavor profile, featuring a balanced blend of heat and savory spices such as paprika, black and red pepper, oregano, and thyme. This fully cooked pork sausage is hardwood smoked and free from artificial flavors, colors, MSG, and by-products. It is an ideal complement to dishes like gumbo, jambalaya, and charcuterie boards. The product is available nationwide at major retailers, including Kroger and Walmart.

Refreshing Decaf Cold Brew Perfect For Caffeine-Free Coffee Experience

Key players operating in the food and beverages market are focusing on the perfect caffeine-free coffee experience. This decaf coffee allows coffee lovers to enjoy the richness of cold brew without the stimulating effects of caffeine, making it perfect for any time of the day. For instance, in December 2024, SToK Cold Brew Coffee, a US-based brand known for its high-quality, responsibly sourced Arabica beans, launched SToK Decaf Cold Brew Coffee. It delivers a bold yet smooth flavor profile without the caffeine, making it suitable for consumption at any time of day. Brewed for a minimum of 10 hours to ensure a smooth, never-bitter taste, the product is offered in two variants: Unsweet and Not Too Sweet. The new white label design differentiates this line from the original SToK offerings. This ready-to-drink beverage is targeted at coffee enthusiasts seeking a caffeine-free alternative while preserving the signature SToK flavor.

Opportunities And Recommendations In The Food And Beverages Market

Opportunities – The top opportunities in the food and beverages markets segmented by type will arise in the meat, poultry and seafood segment, which will gain $505.35 billion of global annual sales by 2029. The top opportunities in the food and beverages markets segmented by nature will arise in the conventional segment, which will gain $1,777.40 billion of global annual sales by 2029. The top opportunities in the food and beverages markets segmented by distribution channel will arise in the supermarkets or hypermarkets segment, which will gain $814.34 billion of global annual sales by 2029. The food and beverages market size will gain the most in the USA at $410.93 billion.

Recommendations- To take advantage of the opportunities, The Business Research Company recommends the food and beverages to focus on expanding regional flavor profiles to broaden product appeal, focus on expanding caffeine-free product lines to meet growing consumer demand, focus on developing convenient protein-rich breakfast solutions, focus on innovating gluten-free dessert offerings for special occasions, focus on healthier snacking alternatives in premium segments, focus on expanding in the animal and pet food segment, expand in emerging markets, continue to focus on developed markets, focus on expanding omni-channel distribution networks, focus on competitive tiered pricing with value differentiation, focus on targeted digital engagement to increase consumer reach, focus on loyalty programs to drive repeat purchases and focus on targeting consumer preferences in the food and beverage market.

Food And Beverages Market Segmentation

The food and beverages market is segmented by type, by nature and by distribution channel.

By Type –

The food and beverages market is segmented by type into:

- a) Alcoholic Beverages

- b) Non-Alcoholic Beverages

- c) Grain Products

- d) Bakery And Confectionery

- e) Frozen, Canned And Dried Food

- f) Dairy Food

- g) Meat, Poultry And Seafood

- h) Syrup, Seasoning, Oils & General Food

- i) Animal And Pet Food

- j) Tobacco Products

- k) Other Types

The meat, poultry and seafood market was the largest segment of the food and beverages market segmented by type, accounting for 23.21% or $1,552.36 billion of the total in 2024. Going forward, the animal and petfood segment is expected to be the fastest growing segment in the food and beverages market segmented by type, at a CAGR of 7.60% during 2024-2029.

By Nature –

The food and beverages market is segmented by nature into:

- a) Organic

- b) Conventional

The conventional market was the largest segment of the food and beverages market segmented by nature, accounting for 87.43% or $5,847.06 billion of the total in 2024. Going forward, the organic segment is expected to be the fastest growing segment in the food and beverages market segmented by nature, at a CAGR of 8.24% during 2024-2029.

By Distribution Channel –

The food and beverages market is segmented by distribution channel into:

- a) Supermarkets Or Hypermarkets

- b) Convenience Stores

- c) E-Commerce

- d) Other Channels

The supermarkets or hypermarkets market was the largest segment of the food and beverages market segmented by distribution channel, accounting for 46.15% or $3,086.12 billion of the total in 2024. Going forward, the e-commerce segment is expected to be the fastest growing segment in the food and beverages market segmented by distribution channel, at a CAGR of 9.90% during 2024-2029.

By Geography - The food and beverages market is segmented by geography into:

o Asia Pacific

- • China

- • India

- • Japan

- • Australia

- • Indonesia

- • South Korea

- • Bangladesh

- • Thailand

- • Vietnam

- • Malaysia

- • Singapore

- • Philippines

- • Hong Kong

- • New Zealand

o North America

o South America

- • Brazil

- • Chile

- • Argentina

- • Colombia

- • Peru

o Western Europe

- • France

- • Germany

- • UK

- • Italy

- • Spain

- • Austria

- • Belgium

- • Denmark

- • Finland

- • Ireland

- • Netherlands

- • Norway

- • Portugal

- • Sweden

- • Switzerland

o Eastern Europe

- • Russia

- • Czech Republic

- • Poland

- • Romania

- • Ukraine

o Middle East

- • Saudi Arabia

- • Israel

- • Iran

- • Turkey

- • UAE

o Africa

- • Egypt

- • Nigeria

- • South Africa

Asia Pacific was the largest region in the food and beverages market, accounting for 37.69% or $2,520.32 billion of the total in 2024. It was followed by North America, Western Europe and then the other regions. Going forward, the fastest-growing regions in the food and beverages market will be Africa and Middle East where growth will be at CAGRs of 9.99% and 9.16% respectively. These will be followed by Western Europe and Eastern Europe where the markets are expected to grow at CAGRs of 6.07% and 5.75% respectively.

Food And Beverages Market Competitive Landscape

Major Competitors are:

Nestlé S.A. PepsiCo Inc. Anheuser-Busch InBev Tyson Foods Inc. Archer-Daniels-Midland Company (ADM) Other Competitors Include:

JBS S.A. Mars Incorporated The Coca-Cola Company Cargill Inc. Imperial brands plc Arnott's Group Bega Cheese Bundaberg Brewed Drinks Storia Foods & Beverages OFI Bulla Dairy Foods Britannia Industries Limited China Resources Beverage Sichuan Viee Beverage Food Co. Fonterra Inner Mongolia Yili Industrial Group Co., Ltd. China Mengniu Dairy Co., Ltd. COFCO Corporation Foshan Haitian Flavouring & Food Co., Ltd. Dali Foods Group Tsingtao Brewery Group Beijing Enterprises Holdings Limited Chain Lawson RX Japan ITO EN Ajinomoto Co., Inc. Kikkoman Corporation Calbee Inc. Suntory Holdings Limited Asahi Group Holdings, Ltd. Kirin Holdings Company, Limited Meiji Holdings Co., Ltd. Maruha Nichiro Corporation Narichan Jollibee Foods Corporation (JFC) Compose Coffee IFF Nongshim Co., Ltd. Ottogi Corporation Pulmuone Co., Ltd. Haitai Confectionery & Foods Co., Ltd. Dongwon F&B Samyang Foods Co., Ltd. Seoul Milk Cooperative Danone Carrefour DSM-Firmenich Donaldson Company Inc Lactalis Group Ferrero Granarolo Ebro Foods Grupo Bimbo Unilever Heineken Kofola CeskoSlovensko a.s. Madeta a.s. Sokolów S.A. Cris-Tim Ursus Breweries Cherkizovo Group Baltika Breweries The Clearly Food & Beverage Company Ltd Arva Flour Mills Inc Protein Industries BioNeutra Lactalis Inc Maple Leaf Foods Olymel Datassential Inc Oasis International Blystone & Donaldson Tyson Foods Inc Del Monte Fresh Produce Ltd The Hain Celestial Group Adams & Brooks Inc The Kraft Heinz Company Dr. Pepper Snapple Group NotCo Ltd Duas Rodas Industrial Bodega Santa Julia (Zuccardi) IMCD Joli Foods S.A.S JBS S.A Grupo Petrópolis Agrosuper Ambev Thurath Al-Madina Emirates Food Industries LLC i-PRO Al Rabie Saudi Foods Company Almarai Company Arab Company for Livestock Development (ACOLID) Al-Watania Company Agthia Group PJSC AWJ Dangote Industries Limited Varun Beverages Limited Abu Auf Group Cadbury FrieslandCampina WAMCO PLC CHI Limited

Author: Abdul Wasay

Food And Beverages Market Size

The global food and beverages market reached a value of nearly $6,721.63 billion in 2022, having grown at a compound annual growth rate (CAGR) of 4.3% since 2017. The market is expected to grow from $6,721.63 billion in 2022 to $9,105.88 billion in 2027 at a rate of 6.3%. The market is then expected to grow at a CAGR of 6.6% from 2027 and reach $12,511.36 billion in 2032.

Growth in the historic period resulted from increase in clean-label, organic, and non-GMO products, rise in alcohol consumption, increased pet ownership by Gen Z and Gen Y adults, strong economic growth in emerging markets, influence of increased demand for processed foods, rise in awareness of benefits of organic products, and growing number of health-conscious consumers

Going forward, rising penetration of organized retail, increasing demand for ready to eat products, faster economic growth and rise in global population will drive the growth. Factors that could hinder the growth of the food and beverages market in the future include stringent regulations, shift Towards vegan eating and the Russian-Ukrainian war.

Food And Beverages Market Drivers

The key drivers of the food and beverages market include:

Increasing Demand For Ready-To-Eat Products

Increasing demand for ready-to-eat products is expected to propel the growth of the food and beverages market during the forecast period. Ready to eat products are available in a variety of forms and make cooking simple. The consumer inclination towards ready-to-eat food such as ice creams, sandwiches, biscuits, soups, pasta, and pizza are increasing due to the high convenience offered by them and this is expected to drive the food and beverages market. For example, in March 2023, according to The Soft Copy, a bi-weekly publication put out by the multimedia students of the Indian Institute of Journalism and New Media, there has been a 20% increase in sales of ready-to-eat food products. The sales were 50% in 2022 and increased to 70% in 2023. Therefore, the increasing demand for ready-to-eat products is expected to positively impact the growth of the food and beverages market going forward.

Food And Beverages Market Restraints

The key restraints on the food and beverages market include:

Shift Towards Vegan Eating

There has been a shift towards a more plant-based diet, due to the perception that a vegetarian diet has several health benefits, such as lower low-density lipoprotein cholesterol levels, lower blood pressure and lower rates of hypertension. Vegetarians are also associated with lower body mass indexes, lower risks of cancer and lower risks of chronic diseases, such as diabetes. Besides, increasing awareness of animal cruelty among consumers is encouraging people to adopt a vegan lifestyle. For example, to meet increased demand for poultry and reducing production costs, birds are often given a steady dose of growth-promoting drugs. Many non-profit organizations are raising awareness about animal cruelty involved in the poultry businesses. For example, Emirates, a UAE-based airline, noted a 154% increase in vegan meals served onboard between 2021 and 2022, with over 280,000 plant-based meals consumed in the past year. Therefore, the shift towards vegan eating is expected to hinder the growth of the food and beverages market during the forecast period.

Food And Beverages Market Trends

Major trends influencing the food and beverages market include:

Shift To Natural Ingredients

Many manufacturers and producers are increasingly using natural ingredients, and have also reduced the use of artificial colors and flavors. Health concerns of consumers are increasing the sales of products with natural ingredients, additives and coloring agents. For example, in March 2022, Galactic, a US-based developer and provider of antimicrobial lactic acid created for the food market, launched Natural Basil Flavor, a new natural ingredient specially designed for meat alternatives and plant-based meals. It is a direct product of fermentation and infusion, an age-old, natural process, perfected by the galactic fermentation experts who were inspired by consumers’ demand for clean and organic foods made solely with ingredients they know and are good for health and the Planet. Further, in 2021, Layn Natural Ingredients, a China-based leader in vertically integrated production of premium quality, plant-based sweeteners and flavors company, introduced clean-label preservation and natural extract ingredients and a solution named SustaNX. It is the newest ingredient in its Plantae™ PRESERVATION series of clean label, natural, polyphenol-rich antioxidant preservation solutions for food, beverage, flavor and fragrance.

Functional Drinks For Hydration And Nutritional Benefits

Focus on functional drinks for hydration and nutritional benefits is the key trend gaining popularity in the food and beverages market. There has been an increased demand for functional beverages, with many individuals seeking drinks to stay hydrated and to maintain nutritional balance. To capitalize on this segment, companies are introducing fortified beverages such as functional juices, and functional water with health benefits, such as water balance, weight management and improved digestion. Major companies offering functional drinks are PepsiCo Inc., Maxinutrition, Glanbia, GNC Holdings, Clif Bar & Company, The Coca-Cola Company, Tera Food & Beverage, Nestle S.A, Red Bull GmbH, Dr Pepper Snapple Group Inc, and Groupe Danone. For example, in March 2022, Tera Food & Beverage, a Thailand-based leader in health beverages with revolutionary nano-liposome technology and zero preservatives, launched 2 herbal-based health and functional drink flavors ‘QminC Ginger with Honey’ and ‘QminC Finger Root with Honey’. It is the first time that a concentrated ginger drink is made available in a ready-to-drink bottle in Thailand. Similarly, in 2021, PepsiCo, a US-based food and beverage company, launched Soulboost, a sparkling water beverage with a splash of real juice and functional ingredients.

Opportunities And Recommendations In The Food And Beverages Market

Opportunities –The top opportunities in the alcoholic-beverages market segmented by type will arise in the beer market segment, which will gain $487.6 billion of global annual sales by 2027. The top opportunities in the non-alcoholic-beverages market segmented by type will arise in the soft drink and ice market segment, which will gain $137.4 billion of global annual sales by 2027. The top opportunities in the grain products market segmented by type will arise in the other grain products market segment, which will gain $63.0 billion of global annual sales by 2027. The top opportunities in the bakery and confectionery market segmented by type will arise in the cookie, cracker, pasta, and tortilla market segment, which will gain $104.2 billion of global annual sales by 2027. The top opportunities in the frozen, canned and dried food market segmented by type will arise in the frozen food market segment, which will gain $81.0 billion of global annual sales by 2027. The top opportunities in the dairy food market segmented by type will arise in the Ice cream and frozen dessert market segment, which will gain $165.8 billion of global annual sales by 2027. The top opportunities in the meat, poultry and seafood market segmented by type will arise in the meat products market segment, which will gain $262.3 billion of global annual sales by 2027. The top opportunities in the syrup, seasoning, oils, and general food market segmented by type will arise in the seasoning and dressing market segment, which will gain $64.2 billion of global annual sales by 2027. The top opportunities in the animal and pet food market segmented by type will arise in the animal food market segment, which will gain $139.0 billion of global annual sales by 2027. The top opportunities in the tobacco products market segmented by type will arise in the cigarettes, cigars, and cigarillos market segment, which will gain $55.3 billion of global annual sales by 2027. The top opportunities in the other food products market segmented by type will arise in the snack food market segment, which will gain $88.0 billion of global annual sales by 2027. The top opportunities in the food and beverages market segmented by nature will arise in the conventional market segment, which will gain $2,218.9 billion of global annual sales by 2027. The top opportunities in the food and beverages market segmented by distribution channel will arise in the supermarkets/hypermarkets market segment, which will gain $1,466.4 billion of global annual sales by 2027. The food and beverages market size will gain the most in China at $289.8 billion.

Recommendations-To take advantage of the opportunities, The Business Research Company recommends the food and beverages companies to focus on use of natural ingredients, focus on functional drinks, focus on clean label products, focus on robotics and automation in meat processing, focus on use of artisan cooking method, expand in emerging markets, continue to focus on developed markets, focus on mergers and acquisitions, provide competitively priced offerings, focus on premium pricing, focus on online marketing, participate in events, focus on use direct-to-consumer (DTC) advertising, target millennials and Gen Z, target local retailers, focus on urban population, increase focus on online consumers and increase focus on the vegan population.

Food And Beverages Market Segmentation

The food and beverages market is segmented by type, by distribution channel and by nature.

By Type -

The food and beverages market is segmented by type into

- a) Alcoholic – Beverages

- b) Non-Alcoholic – Beverages

- c) Grain Products

- d) Bakery And Confectionery

- e) Frozen, Canned And Dried Food

- f) Dairy Food

- g) Meat, Poultry And Seafood

- h) Syrup, Seasoning, Oils And General Food

- i) Animal And Pet Food

- j) Tobacco Products

- k) Other Foods Products.

The meat, poultry and seafood market was the largest segment of the food and beverages market segmented by type, accounting for 22.3% of the total in 2022. Going forward, the other food products segment is expected to be the fastest growing segment in the food and beverages market segmented by type, at a CAGR of 7.6% during 2022-2027.

The alcoholic-beverages market is further segmented by type into

- a) Beer (Breweries)

- b) Wine And Brandy (Wineries)

- c) Spirits (Distilleries)

The beer (breweries) market was the largest segment of the alcoholic-beverages market segmented by type, accounting for 41.4% of the total in 2022. Going forward, the wine and brandy (wineries) segment is expected to be the fastest growing segment in the alcoholic-beverages market segmented by type, at a CAGR of 6.5% during 2019-2023.

The non-alcoholic – beverages market is further segmented by type into

- a) Coffee And Tea

- b) Soft Drink And Ice

The soft drink and ice market was the largest segment of the non-alcoholic-beverages market segmented by type, accounting for 79.9% of the total in 2022. Going forward, the coffee and tea segment is expected to be the fastest growing segment in the non-alcoholic - beverages market segmented by type, at a CAGR of 6.0% during 2022-2027.

The bakery and confectionery market is further segmented by type into

- a) Sugar And Confectionery Products

- b) Cookie, Cracker, Pasta, And Tortilla

- c) Bread And Bakery Products

- d) Breakfast Cereal

The sugar and confectionery product market was the largest segment of the bakery and confectionery market segmented by type, accounting for 38.5% of the total in 2022. Going forward, the cookie, cracker, pasta, and tortilla segment is expected to be the fastest growing segment in the bakery and confectionery market segmented by type, at a CAGR of 6.5% during 2022-2027.

The frozen, canned and dried food market is further segmented by type into

- a) Frozen Food

- b) Canned, And Ambient Food

The canned and ambient food market was the largest segment of the frozen, canned and dried food market segmented by type, accounting for 50.8% of the total in 2022. Going forward, the frozen food segment is expected to be the fastest growing segment in the frozen, canned and dried food market segmented by type, at a CAGR of 6.3% during 2022-2027.

The dairy food market is further segmented by type into

- a) Milk And Butter

- b) Ice Cream And Frozen Dessert

- c) Cheese

- d) Dry, Condensed, Evaporated Dairy Products

The milk and butter market was the largest segment of the dairy food market segmented by type, accounting for 34.8% of the total in 2022. Going forward, the ice cream and frozen dessert segment is expected to be the fastest growing segment in the dairy food market segmented by type, at a CAGR of 9.8% during 2022-2027.

The meat, poultry and seafood market is further segmented by type into

- a) Meat Products

- b) Poultry

- c) Seafood

The meat products market was the largest segment of the meat, poultry and seafood market segmented by type, accounting for 59.8% of the total in 2022. Going forward, the seafood segment is expected to be the fastest growing segment in the meat, poultry and seafood market segmented by type, at a CAGR of 6.7% during 2022-2027.

The syrup, seasoning, oils, and general food market is further segmented by type into

- a) Fats And Oils

- b) Seasoning And Dressing

- c) Flavoring Syrup and Concentrate

The fats and oils market was the largest segment of the syrup, seasoning, oils, and general food market segmented by type, accounting for 45.9% of the total in 2022. Going forward, the seasoning and dressing segment is expected to be the fastest growing segment in the syrup, seasoning, oils, and general food market segmented by type, at a CAGR of 7.1% during 2022-2027.

The animal and pet food market is further segmented by type into

- a) Animal Food

- b) Pet Food

The animal food market was the largest segment of the animal and pet food market segmented by type, accounting for 82.2% of the total in 2022. Going forward, the animal food segment is expected to be the fastest growing segment in the animal and pet food market segmented by type, at a CAGR of 7.8% during 2022-2027.

The tobacco products market is further segmented by type into

- a) Cigarettes, Cigars And Cigarillos

- b) Smoking And Other Tobacco Products

The cigarettes, cigars and cigarillos market was the largest segment of the tobacco products market segmented by type, accounting for 89.4% of the total in 2022. Going forward, the cigarettes, cigars and cigarillos segment is expected to be the fastest growing segment in the tobacco products market segmented by type, at a CAGR of 4.5% during 2022-2027.

The other foods products market is further segmented by type into

- a) Perishable Prepared Food

- b) Snack Food

- c) All Other Miscellaneous Food

The snack food market was the largest segment of the other foods products market segmented by type, accounting for 51.1% of the total in 2022. Going forward, the all-other miscellaneous food segment is expected to be the fastest growing segment in the other foods products market segmented by type, at a CAGR of 8.60% during 2022-2027.

By Distribution Channel -

The food and beverages market is segmented by distribution channel into

- a) Supermarkets/Hypermarkets

- b) Convenience Stores

- c) E-Commerce

- d) Other Channels

The supermarkets/hypermarkets market was the largest segment of the food and beverages market segmented by distribution channel, accounting for 61.7% of the total in 2022. Going forward, the e-commerce segment is expected to be the fastest growing segment in the food and beverages market segmented by distribution channel, at a CAGR of 6.6% during 2022-2027.

By Nature -

The food and beverages market is segmented by nature into

- a) Organic

- b) Conventional

The conventional market was the largest segment of the food and beverages market segmented by nature, accounting for 94.8% of the total in 2022. Going forward, the organic segment is expected to be the fastest growing segment in the food and beverages market segmented by nature, at a CAGR of 8.1% during 2022-2027.

By Geography - The food and beverages market is segmented by geography into

- o Asia Pacific

- • China

- • India

- • Bangladesh

- • Japan

- • Australia

- • Indonesia

- • South Korea

- • Hong Kong

- • Malaysia

- • New Zealand

- • Philippines

- • Singapore

- • Thailand

- • Vietnam

o North America

o South America

- • Brazil

- • Argentina

- • Chile

- • Colombia

- • Peru

o Western Europe

- • UK

- • Germany

- • France

- • Austria

- • Belgium

- • Denmark

- • Finland

- • Ireland

- • Italy

- • Netherlands

- • Norway

- • Portugal

- • Spain

- • Sweden

- • Switzerland

o Eastern Europe

- • Russia

- • Czech Republic

- • Poland

- • Romania

- • Ukraine

o Middle East

- • Saudi Arabia

- • Israel

- • Iran

- • Turkey

- • UAE

o Africa

- • Egypt

- • Nigeria

- • South Africa

Asia Pacific was the largest region in the food and beverages market, accounting for 41.0% of the total in 2022. It was followed by Western Europe, and then the other regions. Going forward, the fastest-growing regions in the food and beverages market will be the Middle East and Africa where growth will be at CAGRs of 13.8% and 13.0% respectively. These will be followed by South America and Western Europe where the markets are expected to grow at CAGRs of 9.6% and 6.4% respectively.

Food And Beverages Market Competitive Landscape

Major Competitors are:

Nestle S.A.

PepsiCo, Inc.

JBS S.A.

Anheuser-Busch InBev

Tyson Foods Inc

Other Competitors Include:

Archer-Daniels-Midland Company (ADM)

Mars, Incorporated

Imperial brands plc

The Coca-Cola Company

Cargill

Dabur

Amul

Asahi Soft Drinks Co Ltd

Red Bull

Del Monte fresh produce ltd

Fonterra Meiji Co Ltd

Dali Foods Group Co Ltd

Hangzhou Wahaha Group Co, Ltd

Nongfu Spring

China Haisheng Juice Holdings Co Ltd

Britannia Industries Ltd

Otsuka Holdings Co Ltd

Suntory Beverage & Food Ltd

Glanbia, Plc

Royal Frieslandcampina N. V

Raisio PLC

Associated British Foods

Boparan Holdings

Arla Foods

Greencore Convenience Foods

Südzucker AG

Tonnies Group

Dr. August Oetker Nahrungsmittel KG

KHS Group

Sicuro Food

Valagro

Gastronomic SPAIN

Mondelez UK

Refresco Tate & Lyle

Diageo

Roust Corporation

Cherkizovo Group

GoodMills Group GmbH

European Drinks S. A

Penam

Vitana

Metarom Group

Košík

Rudolf Jelinek

General Mills

The Hain Celestial Group

Campbell Soup Company

Maple Leaf

Maple Lodge

Olymel

Elmira Pet Products Ltd

Adams & Brooks Inc

The Kraft Heinz Company

Dr. Pepper Snapple Group

Hearthside Food Solutions LLC

Grupo Petrópolis

Monster Energy Co

Rockstar Inc

Unilever

Arcor

Starbucks

Agrosuper

Ambev

Almarai Company

Arab Company for Livestock Development (ACOLID)

Al-Watania Company

Agthia Group PJSC

AWJ

South Beach Beverage Co Inc

Abu Auf Group

Lifeway Foods

Arizona Beverages Company

Twiga Foods

Cadbury Nigeria

FrieslandCampina WAMCO Nigeria PLC

CHI Limited

Nigerian Breweries Plc

SABMiller