Retail Market Definition

The retail market refers to the system where businesses sell goods and services directly to individual consumers for personal use. It is the final stage of the supply chain, where products move from manufacturers or wholesalers to customers through various retail outlets. This market includes both physical stores (supermarkets, department stores) and online platforms (e-commerce websites) and direct sales.

The retail market consists of sales by entities (organizations, sole traders and partnerships) of retail services that are used to purchase daily necessities, luxury items and specialized products, making it an essential component of everyday life. The sector serves individuals, families and businesses seeking consumer goods for immediate use or long-term needs.

All citations copied!

Retail Market Size

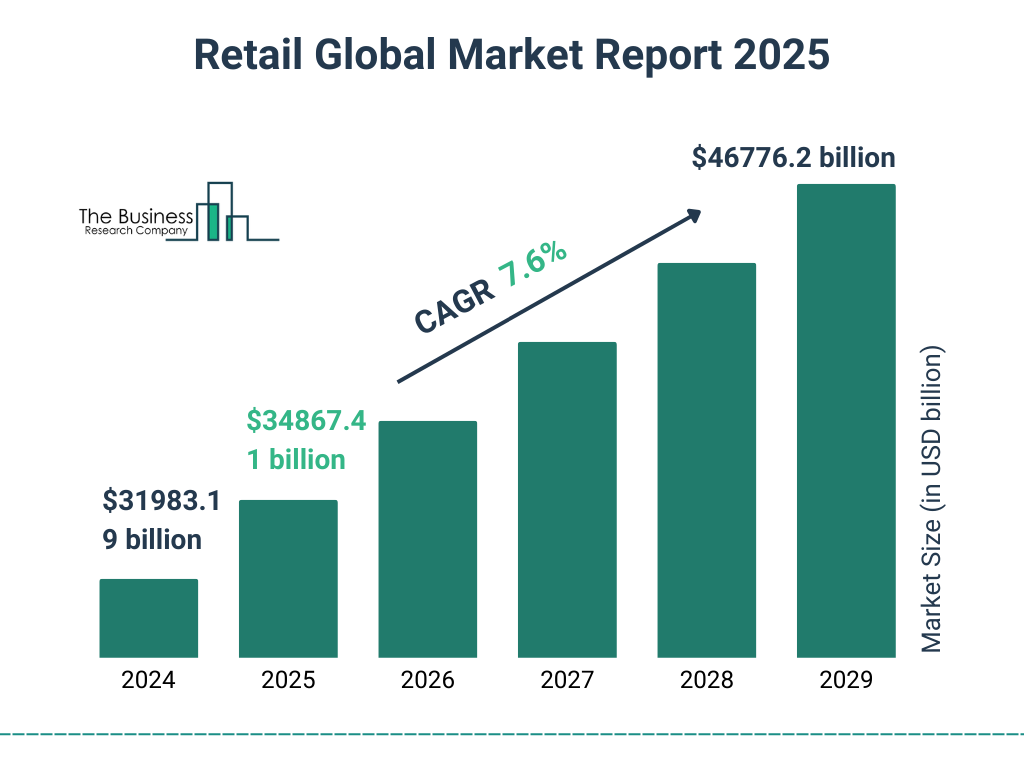

The global retail market reached a value of nearly $28,438.48 billion in 2024, having grown at a compound annual growth rate (CAGR) of 8.57% since 2019. The market is expected to grow from $28,438.48 billion in 2024 to $41,713.66 billion in 2029 at a rate of 7.96%. The market is then expected to grow at a CAGR of 7.92% from 2029 and reach $61,061.98 billion in 2034.

Growth in the historic period resulted from the rise in smartphone penetration, e-commerce growth and expansion of department stores. Factors that negatively affected growth in the historic period were labor shortages and stringent regulations and Compliance.

Going forward, the significant adoption of automation, growth of shopping malls, favorable government initiatives and increase in use of digital payment systems will drive the growth. Factor that could hinder the growth of the retail market in the future include supply chain disruptions and inflation and price sensitivity.

Retail Market Drivers

The key drivers of the retail market include:

Significant Adoption Of Automation

The significant adoption of automation will drive the growth of the retail market during the forecast period. Automation refers to the use of technology, systems, or processes to perform tasks with minimal human intervention. The adoption of automation in retail has significantly boosted efficiency, reduced costs, improved customer experiences and accelerated order fulfillment, driving overall growth in the industry. For instance, in January 2025, the AI (artificial intelligence) in retail survey conducted among 100 US executives with a minimum seniority of Vice President at retail companies by Honeywell, an American publicly traded, multinational conglomerate, found that more than 8 out of 10 retailers plan to increase use of automation and artificial intelligence (AI) across their operations to adapt to changing consumer behaviors, enhance employee skills and improve efficiency for shoppers. 35% of major retailers plan to significantly increase their AI investment. Therefore, the significant adoption of robotics and automation will support the growth of the retail market in the forecast period.

Retail Market Restraints

The key restraints on the retail market include:

Supply Chain Disruptions

Supply chain disruptions is expected to hinder the growth of the retail market during the forecast period. These disruptions refer to unforeseen events that disrupt the seamless movement of goods and services within a supply chain. They negatively impact retail growth by causing inventory shortages, escalating costs and delaying product availability, ultimately resulting in lost sales and decreased customer satisfaction. Additionally, rising logistics and procurement expenses strain profit margins or lead to higher prices, potentially reducing consumer demand and slowing market expansion. For example, in September 2024, Ivalua Inc., a France-based software company, reported that nearly 47% of UK businesses experienced increased supply chain disruptions over the past year, with 45% expecting further disruptions in the next 12 months. Therefore, supply chain disruptions are likely to restrain the retail market's growth.

Retail Market Trends

Major trends shaping the retail market include:

Advancement In Retail With IoT-Integrated Solutions To Optimize Processes

Companies are focusing on Internet of Things (IoT)-integrated solutions to enable retailers to create personalized shopping experiences by tracking customer behavior in-store and online. IoT technology facilitates the creation of smart environments where devices can monitor, control and optimize processes, leading to improved efficiency, accuracy and economic benefit across the retail industry. For instance, in February 2024, Huawei Technologies Co. Ltd., a China-based manufacturing company, launched the Retail Solution. Huawei's Retail Solution is tailored for retail environments including campuses, stores and interconnected branches. It integrates advanced technologies like Wi-Fi (wireless fidelity), cloud computing, IoT and storage to enhance operational efficiency, cost reduction and the consumer experience. The solution comprises four specialized components including a smart store solution, an intelligent warehousing solution optimizing inventory management with IoT, an energy efficiency solution utilizing IoT sensors for smart energy management and a digital marketing solution providing comprehensive store management insights.

Advancements In AI-Powered Solutions For Personalized Retail Experiences

Leading companies in the retail market are prioritizing the adoption of AI-powered solutions to deliver a personalized shopping experience. AI is being increasingly integrated into retail operations to improve customer engagement and optimize processes. Retailers are leveraging AI for personalized marketing, demand forecasting, and inventory management. For instance, in November 2023, Panasonic Connect Europe, a Germany-based technology company, launched a new AI-powered solution to personalize in-store retail. The unique feature of this AI-powered solution is its ability to revolutionize retail by personalizing advertising with generative AI assistants for customers as they shop. Stores can now automatically track shopper demographics, merge this information with buying preferences and contextual factors like weather or local events and immediately customize advertising on in-store displays. Panasonic, in collaboration with ADEAL Systems, a data and AI specialist company based in Germany, has integrated its AI-powered personal shopping assistant, CUSAAS (Customer Segmentation As-a-Service), with advanced retail technology cameras and display solutions to create a next-level shopping experience.

Opportunities And Recommendations In The Retail Market

Opportunities – The top opportunities in the retail markets segmented by type will arise in the ecommerce & other non-store retailers segment, which will gain $3,268.90 billion of global annual sales by 2029. The top opportunities in the retail markets segmented by ownership will arise in the retail chain segment, which will gain $10,670.15 billion of global annual sales by 2029. The top opportunities in the retail markets segmented by distribution channel will arise in the online segment, which will gain $7,099.15 billion of global annual sales by 2029. The retail market size will gain the most in the USA at $2,929.83 billion.

Recommendations- - To take advantage of the opportunities, The Business Research Company recommends the retail companies to focus on iot-integrated retail solutions to enhance operational efficiency and customer engagement, focus on integrating ai for personalized in-store retail experiences, focus on retail cloud solutions to strengthen omnichannel capabilities and personalization, focus on cloud-based erp systems to improve core operations and reduce costs, focus on e-commerce and non-store retailers for business growth, focus on retail chain for business expansion, expand in emerging markets, focus on strategic partnerships to accelerate market expansion and innovation, focus on strategic pricing to enhance competitiveness, strengthening digital and promotional marketing efforts, focus on online retail for strong growth.

Retail Market Segmentation

The Retail market is segmented by service type, by ownership and by distribution channel.

By Service Type –

The Retail market is segmented by service type into:

- a) Motor Vehicle And Parts Dealers

- b) Food And Beverage Stores

- c) Gasoline Stations

- d) Miscellaneous Store Retailers

- e) Cosmetics And Personal Car Stores

- f) Clothing And Clothing Accessories Stores

- g) Electronics And Appliance Stores

- h) Furniture And Home Furnishings Stores

- i) Supermarket And Hypermarkets

- j) Convenience, Mom And Pop Stores

- k) Department Stores And Other General Merchandise Stores

- l) E-Commerce And Other Non-Store Retailers

- m) Building Material And Garden Equipments And Supplies Dealers

- n) Pharmacies And Healthcare Stores

- o) Sporting Goods, Hobby, Musical Instruments and Book Stores

The motor vehicle and parts dealers market was the largest segment of the retail market segmented by type, accounting for 17.83% or $5,071.65 billion of the total in 2024. Going forward, the ecommerce & other non-store retailers segment is expected to be the fastest growing segment in the retail market segmented by type, at a CAGR of 12.22% during 2024-2029.

<

By Ownership –

The Retail market is segmented by ownership into:

- a) Retail Chain

- b) Independent Stores

The retail chain market was the largest segment of the retail market segmented by ownership, accounting for 68.05% or $19,352.45 billion of the total in 2024. Going forward, the retail chain segment is expected to be the fastest growing segment in the retail market segmented by ownership, at a CAGR of 9.18% during 2024-2029.

The Retail market is segmented by distribution channel into:

- a) Supermarkets/Hypermarkets

- b) Convenience Stores

- b) Department Stores

- b) Specialty Stores

- b) Online

- b) Other Distribution Channels

The online market was the largest segment of the retail market segmented by distribution channel, accounting for 24.69% or $7,020.05 billion of the total in 2024. Going forward, the online segment is expected to be the fastest growing segment in the retail market segmented by distribution channel, at a CAGR of 15.00% during 2024-2029.

<

By Geography - The retail market is segmented by geography into:

o Asia Pacific

- • China

- • India

- • Japan

- • Australia

- • Indonesia

- • South Korea

o North America

o South America

o Western Europe

- • France

- • Germany

- • UK

- • Italy

- • Spain

o Eastern Europe

o Middle East

o Africa

North America was the largest region in the retail market, accounting for 32.66% or $9,289.13 billion of the total in 2024. It was followed by Asia Pacific, Western Europe and then the other regions. Going forward, the fastest-growing regions in the retail market will be Middle East and Africa where growth will be at CAGRs of 11.00% and 9.84% respectively. These will be followed by South America and Asia Pacific where the markets are expected to grow at CAGRs of 9.45% and 9.31% respectively.

retail Market Competitive Landscape

Major Competitors are:

Wallmart Inc Amazon.com Inc Costco Wholesale Corp Costco Wholesale Corp The Home Depot Inc Other Competitors Include:

JD.com.Inc.(JD) Aldi (Albrechtdiskont) Walgreens Boots Aliance Inc Target Corp.(TGT) Carrefour Group Star Brands Travel Retail Bluebell Group Star Brands Asia Saks Fifth Avenue Reliance Retail V2 Retail Liverpool FC Wesfarmers Limited Woolworths Group Coles Group Harvey Norman Future Group Huawei Technologies Co. Ltd Cegid JD.com Bailian Group GOME Retail Holdings Dashang Group Better Life Commercial Chain Share Co Lianhua Supermarket Holdings Universal Music Japan Amiri Rakuten Seven & i Holdings Co., Ltd Aeon Co., Ltd Fast Retailing Co., Ltd. Don Quijote Co., Ltdv Yamada Denki Co., Ltd Daiso Industries Co., Ltd J. Front Retailing Co., Ltd Marui Group Co., Ltd Cellini Shinsegae Inc Lotte Shopping Co., Ltd Hyundai Department Store Group GS Retail Homeplus BGF Retail E-Land Retail Shinsegae International Auchan Kingfisher France Redefine Meat Panasonic Connect Europe Amazon Klépierre E.Leclerc Aldi Group Metro AG Esselunga Grupo Eroski Kingfisher plc Apple NTS Retail Compax Software Development GmbH Profi Shell Zabka Polska Eurocash Group Neonet S.A Zedeman Profi Rom Food X5 Retail Group Lenta Dixy Group Dollar General Kurt Geiger Silk & Snow Go Lime Inc HelloFresh Showcase Cantaloupe, Inc Gymshark Walmart Inc. (USA) Amazon.com, Inc. (USA) Costco Wholesale Corporation (USA) The Kroger Company (USA) Walgreens Boots Alliance, Inc. (USA) The Home Depot, Inc. (USA) Target Corporation (USA) Staples (USA) Office Depot (USA) Sportsman's Warehouse Holdings Inc. (USA) Yesway (USA) Casey's General Stores (USA) Love's Travel Stops & Country Stores (USA) Marathon Petroleum Corporation (USA) Alimentation Couche-Tard Inc. (Canada) Loblaw Companies Limited (Canada) Canadian Tire Corporation (Canada) Hudson's Bay Company (Canada) Shopify (Canada) Best Buy Canada RONA Inc. (Canada) The Home Depot Canada Indigo Books & Music (Canada) Aritzia LP (Canada) Uniqlo Canada H&M Canada Staples Canada Empire Company Ltd. (Canada) Grupo Falabella S.A. (Chile) Cencosud S.A. (Chile) Carrefour Brasil S.A. (Brazil) Walmart Inc. (Brazil) Lojas Americanas S.A. (Brazil) Mercado Libre S.A. (Argentina) odimac S.A. (Chile) B2W Digital S.A. (Brazil) E. Leclerc Comércio e Importação S.A. (Brazil) Fomento Económico Mexicano, S.A.B. de C.V. (OXXO) (Mexico) VSBLTY Groupe Technologies Corp JD Sports ARM Rio Chalhoub Group Al-Futtaim Group (UAE) Majid Al Futtaim (UAE) Alshaya Group (Kuwait) Lulu Group International (UAE) Spinneys (UAE) Carrefour (UAE) Azadea Group LLC (UAE) Dubai Duty-Free (UAE) Jumeirah Group (UAE) Syn Nigeria Emirates Zando Amazon.com, Inc. MTN Nigeria Communication Plc Shoprite Holdings (South Africa) Woolworths Holdings Limited (South Africa) Pick n Pay Stores (South Africa) Checkers (South Africa) Massmart (South Africa) Clicks Group (South Africa) Truworths (South Africa) Edcon (South Africa) The Foschini Group (South Africa) Spar Group (South Africa) Jumia Nigeria (Nigeria) Carrefour Egypt (Egypt)

Spinneys Egypt (Egypt) Metro Market (Egypt) Kazyon (Egypt) Hyper One (Egypt)

Author: Abdul Wasay

Retail Market Size

The global retail market reached a value of nearly $20,331.1 billion in 2020, having increasing at a compound annual growth rate (CAGR) of 2.4% since 2015. The market is expected to grow at a CAGR of 7.7% from 2020 to reach $29,446.2 billion in 2025. The global retail market is expected to reach $39,933.3 billion in 2030, at a CAGR of 6.3%.

Growth in the historic period resulted from rapid economic growth in emerging markets, increasing population density in urban areas, foreign direct investment (FDI) in the sector, rising popularity of franchising concept, growing demand for supermarkets, hypermarkets, discount stores and out of town retail parks, and large availability of retail finance options. Factors that negatively affected growth in the historic period were increasing costs, skilled workforce shortages, and unorganized retail in developing countries.

Going forward, technology advancement, impact of data analytics, and consumer preference for shopping local will drive growth. Factors that could hinder the growth of the retail market in the future include rising geopolitical tensions, and outbreak of coronavirus disease (COVID-19).

Retail Market Drivers

The key drivers of the retail market include:

Technology Advancement

Rapid growth in technology is expected to drive market growth during the forecast period. Areas of particular development are likely to be POS (point-of-sale) technology, self-check out technology beacons, robotics, automation and augmented reality. For example, retail companies are increasingly investing in drone technology to reduce delivery times and increase profitability. A drone is an unmanned aerial vehicle (UAV) that is remotely controlled or flies autonomously through software-controlled flight plans in their systems. Major convenience store companies as 7 Eleven have started drone deliveries long before the other small competitors. 7 Eleven started its drone deliveries in December 2016 and completed about 77 such deliveries in a month. Ordered items, including food and over-the-counter medicine, were packed into special containers and flown by drones that used GPS capabilities to find addresses. Also, in 2020, Walmart announced the launch of Alphabot, an automated system which is a grocery picking and packing robot a fastest speed which is expected to increase Walmart efficiency. In Albertosons Cos., a largest supermarket in the USA announced its partnership deal with Toshiba, a technology company to implement self-check out stations in its 24 stores in the USA. Thus, the retail industry is expected to benefit from the greater efficiencies offered by these technologies.

Retail Market Restraints

The key restraints on the retail market include:

Increasing Costs

Rising costs had a negative impact on the growth of the retail market during the historic period. This rise in supply chain costs and increasing costs for developing inventories restrained the market in the historic period. Additionally, companies invested heavily in marketing their products due to intense competition in the market. Rising trucking, railroad, dry-bulk and air-freight rates also negatively impacted the market. This rise in operating costs increased the pressure on companies to protect margins, while maintaining the pricing of their products.

Retail Market Trends

Major trends influencing the retail market include:

Launch of Innovative Technologies in Fuel Retailing

Digital transformation is a key to the future of retail fuel operations and is gaining significant popularity in the retail industry. Innovative technologies such as the Internet of Things (IoT), artificial intelligence (AI), robotics, blockchain, and application programming interfaces (APIs) not only help fuel retailers to track customer usage and spending but to provide customers with their specific requirements and at the right price. For instance, retailers are communicating offers and discounts to drivers via connected cars (part of the IoT) and have started using AI to identify the best time of day to contact consumers, with purchase offers based on website visits and past clicks data. Fuel retailers are providing customers with electronic payment options such as WeChat Pay, AliPay, and PayPal to provide secure and reliable money transfers. Moreover, fuel retailers are recognizing the importance of the digital revolution and are increasingly investing in these technologies. According to the Accenture research study published in April 2019, more than 8 in 10 or 81% of fuel retailers plan to increase their investment in digital technologies over the next three to five years.

E-commerce Stores Setting Up Offline Stores

Many e-commerce retailers started offline store to enable customers to touch and feel products, enhance brand visibility and further drive sales. Birchbox, an e-commerce store opened its first physical store in Soho, New York and companies like Bonobos and War by Parker estimated to have to have increased its brick-and-mortar stores to 100 in 2018. Also, in 2019, Madison Reed, a hair care brand in America announced its plans to open 600 stores by 2024. 2 E-commerce retailers setting up offline stores are good news for brick-and-mortar concept because it validates the need for physical stores.

Opportunities and Recommendations in The Retail Market

Opportunities –The top opportunities in the retail market segmented by type will arise in the ecommerce & other non-store retailers segment, which will gain $2,065.9 billion of global annual sales by 2025. The top opportunities in the retail market segmented by ownership will arise in the chained segment, which will gain $8,624.7 billion of global annual sales by 2025. The retail market size will gain the most in The USA at $1,858.5 billion.

Recommendations-To take advantage of these opportunities, The Business Research Company recommends the companies in the retail market to focus on the use of automation, big data and digitization to improve operational efficiency and to better understand consumer behavior and buying habits, expanding activities to emerging markets to gain market share, offer competitively priced products and services to attract the users, leverage social media to reach targeted audience, among other strategies.

Retail Market Segmentation

The retail market is segmented by type, by ownership and by geography.

By Type -

The retail market is segmented by type into

- a) Motor Vehicles and Parts Dealers

- b) Food and Beverages Stores

- c) Gasoline Stations

- d) Miscellaneous Store Retailers

- e) Cosmetics and Personal Care Stores

- f) Clothing and Clothing Accessories stores

- g) Electronics and Appliance Stores

- h) Furniture and Home Furnishing Stores

- i) Supermarkets and Hypermarkets

- j) Convenience, Mom and Pop Store

- k) Department Stores and Other General Merchandise Stores

- l) Ecommerce and Other Non-Store Retailers

- m) Building Material and Garden Equipment and Supplies Dealers

- n) Pharmacies And Healthcare Stores

- o) Sporting Goods Hobby, Musical Instrument, and Book Stores

The motor vehicle and parts dealers market was the largest segment of the retail market segmented by type, accounting for 19.3% of the total in 2020. Going forward, the ecommerce & other non-store retailers segment is expected to be the fastest growing segment in the retail market segmented by type, at a CAGR of 13.8% during 2020-2025.

Sub-Segment-

By Type -

The motor vehicle and parts dealers market is further segmented by type into

- a) Automobile Dealers

- b) Auto Parts and Accessories

- c) Other motor vehicle dealers.

The automobile dealers market was the largest segment of the motor vehicle and parts dealers market segmented by type, accounting for 83.6% of the total in 2020. Going forward, the auto parts and accessories segment is expected to be the fastest growing segment in the motor vehicle and parts dealers market segmented by type, at a CAGR of 8.2% during 2020-2025.

By Type -

The supermarkets and hypermarkets market is further segmented by type into

- a) Hypermarkets

- b) Supermarkets

The hypermarkets market was the largest segment of the supermarkets and hypermarkets market segmented by type, accounting for 52.7% of the total in 2020. Going forward, the supermarkets segment is expected to be the fastest growing segment in the supermarkets and hypermarkets market segmented by type, at a CAGR of 5.9% during 2020-2025.

By Type -

The ecommerce & other non-store retailers market is further segmented by type into

- a) E-Commerce

- b) Direct Selling Establishments

- c) Vending Machine Operators.

The e-commerce market was the largest segment of the ecommerce & other non-store retailers market segmented by type, accounting for 91.7% of the total in 2020 and is expected to be the fastest growing segment, at a CAGR of 14.4% during 2020-2025.

By Type -

The food and beverage stores market is further segmented by type into

- a) Beer, Wine & Liquor Stores

- b) Specialty food stores.

The beer, wine & liquor stores market was the largest segment of the food and beverage stores market segmented by type, accounting for 78.4% of the total in 2020 and is expected to be the fastest growing segment, at a CAGR of 7.8% during 2020-2025.

By Type -

The gasoline stations market is further segmented by type into

- a) Gasoline – Retail

- b) Diesel – Retail

- c) Gases

- d) Other Gasoline Stations.

The gasoline – retail market was the largest segment of the gasoline stations market segmented by type, accounting for 42.1% of the total in 2020. Going forward, the gases segment is expected to be the fastest growing segment in the gasoline stations market segmented by type, at a CAGR of 9.3% during 2020-2025..

By Type -

The department stores & other general merchandise stores market is further segmented by type into

- a) Department Stores

- b) Other General Merchandise Stores

The other general merchandise stores market was the largest segment of the department stores & other general merchandise stores market segmented by type, accounting for 84.9% of the total in 2020 and is expected to be the fastest growing segment, at a CAGR of 9.9% during 2020-2025.

By Type -

The clothing and clothing accessories stores market is further segmented by type into

- a) Clothing/Apparel Stores

- b) Footwear Stores

- c) Jewelry & Watch Stores

- d) Optical goods stores

The clothing/apparel stores market was the largest segment of the clothing and clothing accessories stores market segmented by type, accounting for 68.1% of the total in 2020 and is expected to be the fastest growing segment, at a CAGR of 6.6% during 2020-2025.

By Type -

The building material and garden equipment and supplies dealers market is further segmented by type into

- a) Building Material and Supplies Dealers

- b) Lawn and Garden Equipment and Supplies Stores

The building material and supplies dealers market was the largest segment of the building material and garden equipment and supplies dealers market segmented by type, accounting for 59.9% of the total in 2020. Going forward, the lawn and garden equipment and supplies stores segment is expected to be the fastest growing segment in the building material and garden equipment and supplies dealers market segmented by type, at a CAGR of 9.0% during 2020-2025.

By Type -

The pharmacies and healthcare stores market is further segmented by type into

- a) Pharmacies and Drug Stores

- b) Other Health and Personal Care Stores.

The pharmacies and drug stores market was the largest segment of the pharmacies and healthcare stores market segmented by type, accounting for 93.7% of the total in 2020. Going forward, the other health and personal care stores segment is expected to be the fastest growing segment in the pharmacies and healthcare stores market segmented by type, at a CAGR of 6.8% during 2020-2025.

By Type -

The electronics and appliance stores market is further segmented by type into

- a) Consumer Electronics Stores

- b) Hardware Suppliers & Security Stores

The consumer electronics stores market was the largest segment of the electronics and appliance stores market segmented by type, accounting for 83.8% of the total in 2020. Going forward, the hardware suppliers & security stores segment is expected to be the fastest growing segment in the electronics and appliance stores market segmented by type, at a CAGR of 7.6% during 2020-2025.

By Type -

The convenience, mom and pop stores market is further segmented by type into

- a) Convenience Stores

- b) Mom and Pop Stores

The convenience stores market was the largest segment of the convenience, mom and pop stores market segmented by type, accounting for 54.1% of the total in 2020. Going forward, the mom and pop stores segment is expected to be the fastest growing segment in the convenience, mom and pop stores market segmented by type, at a CAGR of 8.5% during 2020-2025.

By Type -

The sporting goods, hobby, musical instrument, and book stores market is further segmented by type into

- a) Sporting Goods Stores

- b) Hobby, Toy, and Game Stores

- c) Musical Instrument and Supplies Stores

- d) Other Sporting Goods, Hobby, Musical Instrument, and Book Stores.

The sporting goods stores market was the largest segment of the sporting goods, hobby, musical instrument, and book stores market segmented by type, accounting for 59.5% of the total in 2020 and is expected to be the fastest growing segment, at a CAGR of 6.0% during 2020-2025.

By Type -

The furniture and home furnishings stores market is further segmented by type into

- a) Furniture Stores

- b) Home Furnishings Stores

The furniture stores market was the largest segment of the furniture and home furnishings stores market segmented by type, accounting for 61.2% of the total in 2020. Going forward, the home furnishings stores segment is expected to be the fastest growing segment in the furniture and home furnishings stores market segmented by type, at a CAGR of 6.7% during 2020-2025.

By Type -

The cosmetics and personal care stores market is further segmented by type into

- a) Cosmetics Stores

- b) Hair Care Stores

- c) Skin Care Stores

The cosmetics stores market was the largest segment of the cosmetics and personal care stores market segmented by type, accounting for 49.7% of the total in 2020 and is expected to be the fastest growing segment, at a CAGR of 7.5% during 2020-2025.

By Ownership-

The retail market is further segmented by ownership into

- a) Chained

- b) Independent

The chained market was the largest segment of the retail market segmented by ownership, accounting for 77.6% of the total in 2020 is expected to be the fastest growing segment, at a CAGR of 9.1% during 2020-2025.

By Geography-

The retail market is segmented by geography into

- o North America

o Western Europe

- • UK

- • Germany

- • France

- • Austria

- • Belgium

- • Denmark

- • Finland

- • Ireland

- • Italy

- • Netherlands

- • Norway

- • Portugal

- • Spain

- • Sweden

- • Switzerland

o Asia Pacific

- • China

- • Japan

- • India

- • Australia

- • Indonesia

- • South Korea

- • Hongkong

- • Malaysia

- • New Zealand

- • Philippines

- • Singapore

- • Thailand

- • Vietnam

o Eastern Europe

- • Russia

- • Czech Republic

- • Poland

- • Romania

o South America

- • Brazil

- Argentina

- • Chile

- • Colombia

- • Venezuela

- • Peru

o Middle East

- • Saudi Arabia

- • Israel

- • Turkey

- • UAE

o Africa

- • Egypt

- • Nigeria

- • South Africa

Asia-Pacific was the largest region in the global retail market, accounting for 34.7% of the total in 2020. It was followed by North America, Western Europe, and then the other regions. Going forward, the fastest-growing regions in the retail market will be South America, and the Middle East, where growth will be at CAGRs of 12.4% and 10.4% respectively. These will be followed by the Eastern Europe, and Africa where the markets are expected to grow at CAGRs of 8.84% and 8.83% respectively, during 2020-2025.

Retail Market Competitive Landscape

Major Competitors In The Retail Market are:

Walmart Inc.

Amazon.com, Inc

CVS Health Corporation

Costco Wholesale Corporation

Schwarz Group

Other Competitors In The Retail Market Include:

Walgreens Boots Alliance, Inc

The Home Depot Inc.

Target Corporation

Nice Tuan

Easyhome New Retail Group Co. Ltd.

Bianlifeng

Suning.com

Seven-Eleven

Lawson

Family Mart

Ministop

V-Mart Retail

Infiniti Retail Ltd

Uniqlo

Seven & I Holdings Co., Ltd.

Muji

JB Hi-Fi

Auchan Holding SA

Tesco

Metro AG

Aldi GmbH & Co. KG

Sainsbury's

Co-operative Group Limited

McColl's

Wm Morrison Supermarkets plc

Waitrose & Partners

Groupe Casino

Marks and Spencer Group plc

Mercadona

Musgrave Group Ltd.

Asda Stores Ltd.

Carrefour

X5 Retail Group

Magnit

Profi

Lenta

Dixy Group

Stokrotka Sp. z o.o.

Perekrestok Express

O’Key Group

Globus

Zabka

Spolem

Rewe Group

Groszek

Eurocash

Staples

Office Depot

Sportsman's Warehouse Holdings Inc.

Kroger Co.

Empire Company Ltd.

Yesway

Alimentation Couche-Tard

Casey's general stores

Love's Travel Stops & Country Stores

Marathon Petroleum Corporation

Needs Convenience

OXXO

Cencosud

Makro Atacadista S.A.

LojasAmericanas

Grupo Pão de Açúca

RaízenConveniências

Cia Brasileira de Distribuicao (GPA)

Majid Al Futtaim

AlHokair Fashion Retail

Azadea Group

Savola

Almeera Group

Al Madina Group

Lulu

Al Tayer Group

Circle K

Choppies (South Africa)

Shoprite Holdings

Pick n Pay Stores

Massmart

Woolworths Holdings Limited

FreshStop

Pick n Pay

SPAR

OK

Freshzo Foods

Food Lover’s Market