Aerospace & Aviation operational cascades

Air-traffic capacity constraints, FAA staffing strains or certification delays cause immediate, visible impacts: flight disruptions, longer turnaround times, deferred MRO work and supply-chain congestion. For OEMs and Tier-1 suppliers, missed certification windows and late shipments translate directly to revenue deferral and contract penalties. Executives should map which product lines and customers are U.S-gateway dependent and stress-test production schedules under realistic delay scenarios.

Priority question for leaders: Which plants, parts and customers face the highest probability of delivery disruption within 6–12 weeks?

Government Contracting & Defense Industrial Base procurement and liquidity stress

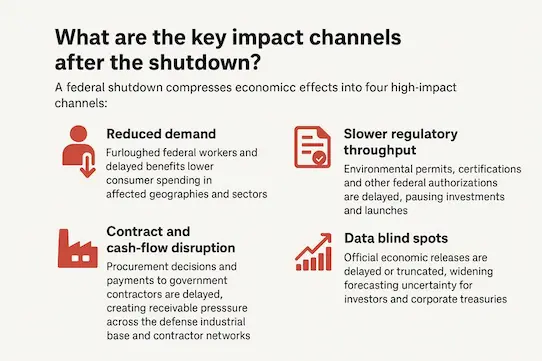

Defense and government contractors depend on predictable procurement cycles and steady cash flows. Payment delays or paused contract awards disproportionately harm smaller suppliers, forcing higher working-capital costs and raising default risk. Global subsidiaries of U.S. primes may face certification or approval slowdowns, opening windows for non-U.S. competitors to capture work.

Priority question for leaders: Which contracts would be materially impacted by a 30- to 90-day pause in awards or payments, and what’s the contingency liquidity plan?

Financial Markets & Macro decision-making with fogged lenses

When official releases are missing, CFOs and portfolio managers operate with larger confidence intervals. That raises risk premia, complicates capital planning and may increase borrowing costs. Firms that rely on precise macro inputs for pricing, hedging or investment timing must adopt alternative indicators and widen stress-test parameters.

Priority question for leaders: What alternative data sources can substitute for delayed official indicators, and how will that change our treasury and investment rules?

Travel, Tourism & Business Travel demand sensitivity

Travel bookings, corporate travel budgets and local tourism revenues are sensitive to furloughs and travel advisories. U.S. federal shutdowns affect national sites and airport operations, which in turn reduce inbound tourism and business travel. Digital platforms and hospitality chains with high U.S. exposure should model demand shocks and reallocate marketing and route planning accordingly.

Priority question for leaders: What percentage of current bookings or revenue flows through U.S. nodes, and how quickly can promotional or routing strategies be shifted?

Global spill-over emerging markets and supply finance

The U.S. is a major demand node and liquidity provider. Prolonged uncertainty elevates global risk premia and tightens dollar funding a particular problem for emerging-market borrowers and exporters. Multinationals must evaluate revenue concentration and the balance-sheet sensitivity to USD volatility.

Priority question for leaders: Which markets and product lines are most sensitive to a 1–3% slowdown in U.S. demand?