Water And Sewage Market Definition

Water and sewage market refers to the industry responsible for the collection, treatment, distribution, and disposal of water and wastewater. This market includes the infrastructure, services, and technologies used to manage fresh water supply, sewage treatment, and wastewater management for residential, commercial, industrial, and municipal use. The primary purpose includes collecting and treating sewage and wastewater to remove contaminants before safely discharging it back into the environment or reusing it.

The water and sewage market consists of sales of water and sewage treatment services by entities (organizations, sole traders and partnerships) that operate water treatment plants and water supply and sewer systems. Water and sewage services provide treatment facilities that helps to treat water and sewage.

All citations copied!

Water And Sewage Market Size

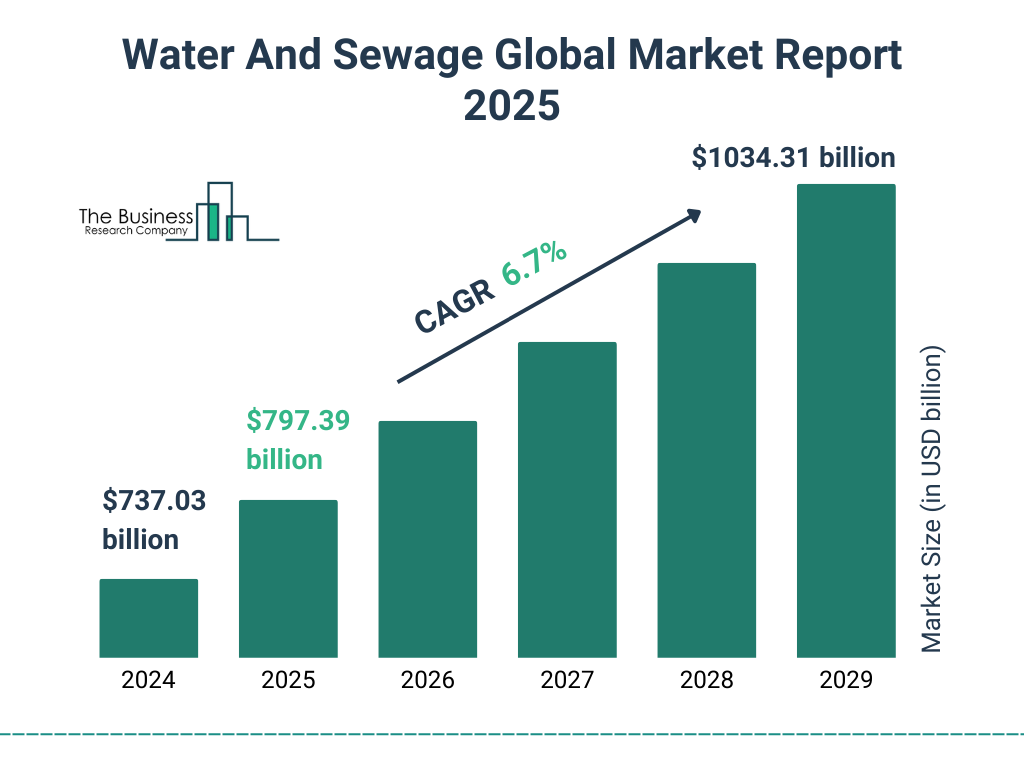

The global water and sewage market reached a value of nearly $7,14,564.70 million in 2024, having grown at a compound annual growth rate (CAGR) of 5.96% since 2019. The market is expected to grow from $7,14,564.70 million in 2024 to $9,92,363.05 million in 2029 at a rate of 6.79%. The market is then expected to grow at a CAGR of 6.41% from 2029 and reach $1,354,099.25 million in 2034.

Growth in the historic period resulted from increasing environmental concerns, large amount of untreated wastewater and favorable government initiatives. Factors that negatively affected growth in the historic period were aging infrastructure and land acquisition issues.

Going forward, growing industrialization, rising water scarcity and conservation efforts, rise in smart city initiatives and rising investments in water infrastructure will drive the growth. Factor that could hinder the growth of the water and sewage market in the future include funding gaps and stringent regulations.

Water And Sewage Market Drivers

The key drivers of the water and sewage market include:

Growing Industrialization

The growing industrialization is expected to propel the growth of the water and sewage market, during the forecast period. The expansion of industries increases demand for water supply infrastructure and wastewater treatment facilities due to the high-water consumption required for manufacturing, cooling and processing. Additionally, industrial activities generate substantial wastewater containing chemicals, heavy metals and organic pollutants. Strict environmental regulations mandate proper treatment of these effluents, driving growth in the sewage treatment sector. For example, in August 2024, according to the National Bureau of Statistics of China, a China-based government agency, industrial production in China increased 5.10% in July 2024, over the same month in the previous year. Additionally, industrial production in India increased 5.90% in May 2024, over the same month in the previous year. Therefore, the growing industrialization will drive the growth of the water and sewage market.

Water And Sewage Market Restraints

The key restraints on the water and sewage market include:

Funding Gaps

During the forecast period, the funding gaps are expected to hinder the growth of the water and sewage market. Many water and sewage systems are outdated and in urgent need of repair or upgrades. Insufficient funding leads to increased leaks, pipe bursts and sewage overflows, causing inefficiencies and potential health risks. Additionally, rapid urbanization drives higher demand for these services, yet financial constraints hinder infrastructure expansion, particularly in rural and low-income areas. This lack of investment exacerbates disparities in access to clean water and proper sanitation. For example, in June 2024, according to United Nations Water, a Switzerland-based interagency mechanism that coordinates the efforts of United Nations entities and international organizations working on water and sanitation, developing countries allocate approximately 0.5% of their GDP to water infrastructure annually, creating a significant funding gap. This shortfall hinders efforts to upgrade aging systems and expand essential services. Therefore, the funding gaps will restrain the growth of the water and sewage market.

Water And Sewage Market Trends

Major trends shaping the water and sewage market include:

Transforming Aging Water Infrastructure For Enhanced Efficiency

Leading companies operating in the water and sewage market are focusing on transforming the aging water infrastructure by investing in advanced technologies. This transformation aims to enhance efficiency, reduce water loss and ensure reliable service delivery while meeting regulatory standards. For instance, in February 2025, Vortex Companies, a US-based provider of trenchless infrastructure solutions, launched Vortex Water, a new division dedicated to transforming aging water infrastructure. The goal is to offer sustainable, high-performance solutions to municipalities dealing with critical water infrastructure issues. This initiative broadens Vortex's expertise beyond sewer and industrial rehabilitation to include the restoration of aging water systems. By utilizing advanced materials, trenchless technologies and innovative solutions, it aims to address the deterioration of water pipelines and infrastructure, which can lead to frequent failures like water main breaks—occurring approximately every two minutes in the U.S..

Advanced Filtration Technologies In Wastewater Management

Major companies operating in the water and sewage market are focusing on developing innovative wastewater systems that integrate advanced treatment technologies, such as membrane filtration and biological nutrient removal. These innovations aim to enhance water quality, reduce environmental impact and increase the efficiency of wastewater management. For instance, in May 2024, Synagro Technologies, Inc., a US-based company that provides water and sewage services, launched the SynaPure Water and Wastewater Treatment System. This innovative technology offers sustainable and cost-effective solutions for treating complex influent streams, including landfill leachate, industrial wastewater and lagoon wastewater. The SynaPure system is engineered to eliminate a broad spectrum of contaminants, such as chemical oxygen demand (COD), suspended and dissolved solids, nutrients, metals, per- and polyfluoroalkyl substances (PFAS) and emerging pollutants, achieving efficiency rates of up to 98% in contaminant removal. This launch supports Synagro's sustainable growth strategy, boosting its ability to deliver clean water solutions to industrial users and wastewater facilities throughout North America.

Opportunities And Recommendations In The Water And Sewage Market

Opportunities – The top opportunities in the water and sewage markets segmented by type will arise in the water supply and irrigation systems segment, which will gain $1,33,024.34 millions of global annual sales by 2029. The top opportunities in the water and sewage markets segmented by operator will arise in the public segment, which will gain $1,92,969.06 millions of global annual sales by 2029. The top opportunities in the water and sewage markets segmented by end user will arise in the industrial segment, which will gain $1,17,123.46 millions of global annual sales by 2029. The water and sewage market size will gain the most in the USA at $61,750.62 million.

Recommendations- To take advantage of the opportunities, The Business Research Company recommends the water and sewage companies to focus on upgrading aging infrastructure with advanced technologies, focus on advanced treatment systems to improve efficiency and environmental compliance, focus on optimizing plant efficiency through digital solutions, focus on innovative industrial water treatment solutions, expand in emerging markets, continue to focus on developed markets, focus on expanding reach through strategic partnerships in underserved regions, focus on adopting tiered pricing to balance cost recovery and affordability, focus on building trust through transparency and education, focus on digital channels to improve customer outreach and feedback and focus on targeting industrial end-users through specialized personnel and technical expertise.

Water And Sewage Market Segmentation

The water and sewage market is segmented by type, by operator and by end user.

By Type –

The water and sewage market is segmented by type into:

- a) Water Supply And Irrigation Systems

- b) Sewage Treatment Facilities

- c) Steam And Air Conditioning Supply

- d) Other Types

The water supply and irrigation systems market was the largest segment of the water and sewage market segmented by type, accounting for 50.97% or $3,64,200.05 million of the total in 2024. Going forward, the sewage treatment facilities segment is expected to be the fastest growing segment in the water and sewage market segmented by type, at a CAGR of 7.81% during 2024-2029.

By Operator –

The water and sewage market is segmented by operator into:

- a) Public

- b) Private

- b) Other Operators

The public market was the largest segment of the water and sewage market segmented by operator, accounting for 70.78% or $5,05,776.05 million of the total in 2024. Going forward, the private segment is expected to be the fastest growing segment in the water and sewage market segmented by operator, at a CAGR of 7.06% during 2024-2029.

By Banking Mode –

The water and sewage market is segmented by banking mode into:

- a) Residential

- b) Commercial

- c) Industrial

- d) Agriculture

- e) Other End User

The industrial market was the largest segment of the water and sewage market segmented by end user, accounting for 35.83% or $2,56,026.31 million of the total in 2024. Going forward, the industrial segment is expected to be the fastest growing segment in the water and sewage market segmented by end user, at a CAGR of 7.83% during 2024-2029.

By Geography - The water and sewage market is segmented by geography into:

o Asia Pacific

- • China

- • India

- • Japan

- • Australia

- • Indonesia

- • South Korea

- • Bangladesh

- • Thailand

- • Vietnam

- • Malaysia

- • Singapore

- • Philippines

- • Hong Kong

- • New Zealand

o North America

o South America

- • Brazil

- • Chile

- • Argentina

- • Colombia

- • Peru

o Western Europe

- • France

- • Germany

- • UK

- • Italy

- • Spain

- • Austria

- • Belgium

- • Denmark

- • Finland

- • Ireland

- • Netherlands

- • Norway

- • Portugal

- • Sweden

- • Switzerland

o Eastern Europe

- • Russia

- • Czech Republic

- • Poland

- • Romania

- • Ukraine

o Middle East

- • Saudi Arabia

- • Israel

- • Iran

- • Turkey

- • UAE

o Africa

- • Egypt

- • Nigeria

- • South Africa

North America was the largest region in the water and sewage market, accounting for 33.39% or $2,38,576.44 million of the total in 2024. It was followed by Asia Pacific, Western Europe and then the other regions. Going forward, the fastest-growing regions in the water and sewage market will be Africa and South America where growth will be at CAGRs of 9.60% and 9.54% respectively. These will be followed by Middle East and Asia Pacific where the markets are expected to grow at CAGRs of 9.52% and 8.34% respectively.

Water And Sewage Market Competitive Landscape

Major Competitors are:

Veolia Environment SA Companhia de Saneamento Basico-Sabesp American Water Works Company Inc. Water Corporation Thames Water Utilities Limited Other Competitors Include:

Xylem Inc. Severn Trent plc United Utilities Group plc Engie SA Huaneng Power International Inc. Evoqua Water Technologies SUEZ Group Clean TeQ Water Limited Sauber Environmental Solutions Pvt Ltd Adroit Associates Private Limited SWA Water Australia WOG Group Thermax Limited Kurita Water Industries Ltd Aquatech Systems (Asia) Pvt. Ltd Toshiba Water Solution & Services Pvt. Ltd Hindustan Dorr-Oliver Ltd Doosan Corporation VA Tech Wabag Ltd Allpipe Technologies Fluidchem Valves (I) Pvt Ltd Samyang Corporation Samsung Electronics Co., Ltd Hung Hua Construction CTCI Group FujiClean CO., LTD. Henan Zhong An Electronic Detection Technology CO., LTD iangsu Jiuwu Hi-Tech Co. Ltd Xi an QingYun Water Treatment Tech Co. Ltd Shanghai Dazhang Filtration Equipment Co., Ltd Mitsubishi Heavy Industries, Ltd Korea Water Resources Corporation (K-water) Kolon Water & Energy Co., Ltd Hanyang Corporation Pentair plc Kemira Global Mott MacDonald Remondis Group Feralco Group Hydrite Chemical Co Italmatch Chemicals S.p.A. Skanska AB The York Water Company Lenntech B.V. Evonik Industries AG Salinity Solutions Limited Alfa Laval AB Ekopak Westlake Vinnolit GmbH & Co. KG Kurita Europe GmbH SNF Floerger Lanxess AG ABB Group Membion GmbH ACA Pescara De Watergroep European Water Association (EWA) European Association of Public Water Operators Croatian Water and Waste Water Association (GVIK) Water Supply and Sewerage Association of the Czech Republic (SOVAK) Hungarian Water Utility Association (MaViz) Romanian Water Association (ARA) Nexus Water Group Neptune Water Solutions Corix Infrastructure Services (US) Inc Prince Rupert Veolia North America American Water Works Company, Inc Aqua America, Inc AquaTec AECOM Canada Stantec Inc SUEZ Water Technologies & Solutions Fluence Corporation Ecolab Aegea Sanitation Sabesp (Basic Sanitation Company of the State of São Paulo) BRK Environmental Iguá Sanitation Aguas Andinas (Andean Waters) Essbio (Bio Waters) AES Arabia Ltd. Emvees Wastewater Treatment LLC Metito Abu Dhabi National Energy Company (TAQA) PASSAVANT Energy & Environment GmbH Ivanhoe Mines WEC Projects Lektratek Water Technology Maskam Water PCI Africa (formerly Paterson Candy International) Aquamat SA Pty Ltd Water Icon

Author :

Girish Kavali

Water and Sewage Market Size

The global water and sewage market size reached a value of nearly $578.4 billion in 2021, having increased at a compound annual growth rate (CAGR) of 3.4% since 2016. The global water and sewage market size is expected to grow from 578.41 billion in 2021 to $852.92 billion in 2026 at a rate of 7.1%. The global water and sewage market size is then expected to grow at a CAGR of 8.3% from 2026 and reach $1,271.20 billion in 2031.

Growth in the historic period resulted from an increase in regulations of government for wastewater treatment, rapid urbanization, growing wastewater complexities, increased demand for water from agricultural sector, increased demand for steam and air-conditioning supply, and emerging markets growth.

Going forward, the rise in global population, rapidly diminishing freshwater resources, increasing demand for wastewater treatment, industrial pollutions, awareness on cleanliness and increasing smart cities will drive growth. Factors that could hinder the growth of the water and sewage market in the future include high cost of water treatment technology.

Water and Sewage Market Drivers

The key drivers of the water and sewage market include:

Rapidly Diminishing Fresh Water Resources

The rapid diminishing of freshwater resources will drive the water and sewage market. The total amount of water on the planet is estimated to be 1 400 million cubic kilometres. However, only 0.003% of this large volume, or around 45 000 cubic kilometres, are "fresh water resources" that might be used for drinking, sanitation, agriculture, and industry. However, not all of this water is accessible since during seasonal floods, some of it runs into isolated rivers. And, as both population and temperature continue to rise, the freshwater is under serious strain. Water is difficult to transport over long distances, and human requirements, both for food and industry, are increasing. According to a Nasa-led study, many of the world’s freshwater sources are being drained faster than they are being replenished. Of the world’s major aquifers (gravel and sand-filled underground reservoirs), 21 out of 37 are receding, from India and China to the United States and France. The Ganges Basin in India is depleting, due to population and irrigation demands, by an estimated 6.31 centimeters every year. Hence, the rapid diminishing of freshwater will propel the growth of the water and sewage market.

Water and Sewage Market Restraints

The key restraints on the water and sewage market include:

High Cost Of Water Treatment Technology

The high cost of water treatment technology will restrain the growth of the water and sewage market. Primary, secondary, and tertiary treatment are the three stages of wastewater treatment. Wastewater treatment necessitates specialized knowledge and abilities. These procedures necessitate a significant amount of capital. The Development Bank of Latin America (CAF), for example, estimates that USD 80 billion will be spent on sewage infrastructure and USD 33 billion on wastewater treatment between 2010 and 2030. Flow rates of effluent, water quality, the required degree of purity, and building materials are all factors that raise the cost of wastewater treatment. The chemical composition and content of the effluent stream to be treated is a crucial element in the cost of most wastewater treatment systems. It's critical to fully comprehend the types and amounts of compounds present, as well as any variations in the effluent stream's composition. In general, the higher the number of contaminants present, the more steps in the water treatment process are necessary, and the higher the initial cost. Thus, the high cost of wastewater treatment will negatively impact the market growth market growth.

Water and Sewage Market Trends

Major trends influencing the water and sewage market include:

Advanced Technologies To Treat Micro Pollutants

Conventional wastewater treatment plants are using advanced technologies to treat micro pollutants. Micro-pollutants are contaminants originating from pharmaceutical residues, household chemicals, personal care products and pesticides. Technologies such as moving bed biofilm reactors (MBBR), ozone-based advanced oxidation, adsorption and powdered activated carbon (PAC) are being used to remove micro-pollutants from wastewater. There has been a growing focus on removing micro-pollutants from wastewater streams in European countries such as Germany and Switzerland. In Germany, advanced technologies such as GE’s membrane bioreactor and powdered activated carbon technology are proving to be a cost-effective way of removing micro-pollutants from wastewater. For instance, some of the major companies using advanced technologies to treat micro-pollutants include Suez Group, Arvia, and Novartis.

Drip Irrigation Systems

Drip irrigation system is an efficient technique to deliver water directly to the roots of the crop and reduce the wastage of water. Drip irrigation is a method of water irrigation in which water passes through a filter and into customized drip pipes with spaced emitters. A particular slow-release system distributes water straight into the soil near the roots through the emitters. Drip irrigation can help achieve water conservation by lowering evaporation and deep drainage if it is correctly designed, installed, and managed. Only the immediate root zone of each plant is wetted, as opposed to other methods of irrigation (sprinkler irrigation or surface irrigation). As a result, this can be a very effective irrigation method. For food or plant producing fields, drip irrigation can be a very technological irrigation technique. However, it is a low-tech approach when compared to more technical methods (such as spray irrigation). It is also feasible to use the treated water as irrigation water by combining this system with a water treatment plant (e.g., non-planted filter or artificial)

Opportunities And Recommendations In The Water and Sewage Market

Opportunities –The top opportunities in the water and sewage market segmented by type will arise in the Water Supply and Irrigation Systems segment, which will gain $143.1 billion of global annual sales by 2026. The top opportunities in segment by end-user will arise in the residential segment, which will gain $88.6 billion of global annual sales by 2026. The top opportunities in segment by public operator will arise in the type of operator segment, which will gain $229.4 billion of global annual sales by 2026. The water and sewage market size will gain the most in the USA at $51.5 billion.

Recommendations –To take advantage of the opportunities, The Business Research Company recommends the water and sewage companies to focus on adopting advanced technologies to treat micro-pollutants, focus on using artificial intelligence, focus on adopting energy efficient technologies, expand in emerging markets, expand in countries offering incentives, scale up through partnerships and acquisitions, provide competitively priced offerings in low-income countries, offer value-based pricing, focus on direct marketing, leverage social media use to maximize reach and focus on urban population.

Water and Sewage Market Segmentation

The water and sewage market is segmented by type, by end-users and by operator.

By Type -

The water and sewage market is segmented by type into:

- a) Water Supply and Irrigation Systems

- b) Sewage Treatment Facilities

- c) Steam and Air-Conditioning Supply

The water supply and irrigation systems market was the largest segment of the water and sewage market segmented by type, accounting for 51.1% of the total in 2021. Going forward, both water supply and irrigation systems and sewage treatment facilities market is expected to be the fastest growing segment in the water and sewage market segmented by technology, at a CAGR of 7.4% during 2021-2026.

By End-Users -

The water and sewage market is segmented by end-users into:

- a) Residential

- b) Commercial

- c) Industrial

- d) Agriculture

The residential market was the largest segment of the water and sewage market segmented by end-user, accounting for 29.6% of the total in 2021. Going forward, the residential segment is expected to be the fastest growing segment in the water and sewage market segmented by end-user, at a CAGR of 7.7% during 2021-2026.

By Operator -

The water and sewage market is segmented by operator into:

The public operator market was the largest segment of the water and sewage market segmented by end-user channel, accounting for 91.7% of the total in 2021. Going forward, the private operator segment is expected to be the fastest growing segment in the water and sewage market segmented by end-user, at a CAGR of 12.2% during 2021-2026.

By Geography- The water and sewage market is segmented by geography into:

- o Asia Pacific

- • China

- • India

- • Japan

- • Australia

- • Indonesia

- • South Korea

- • Hong Kong

- • Malaysia

- • New Zealand

- • Philippines

- • Singapore

- • Thailand

- • Vietnam

o North America

o South America

- • Brazil

- • Argentina

- • Chile

- • Colombia

- • Peru

- • Venezuela

o Western Europe

- • UK

- • Germany

- • France

- • Austria

- • Belgium

- • Denmark

- • Finland

- • Ireland

- • Italy

- • Netherlands

- • Norway

- • Portugal

- • Spain

- • Sweden

- • Switzerland

o Eastern Europe

- • Russia

- • Czech Republic

- • Poland

- • Romania

o Middle East

- • Saudi Arabia

- • Israel

- • Turkey

- • UAE

o Africa

- • Egypt

- • Nigeria

- • South Africa

Asia Pacific was the largest region in the global water and sewage market, accounting for 33.3% of the total in 2021. It was followed by North America, and then the other regions. Going forward, the fastest-growing regions in the global water and sewage market will be Middle East, and South America where growth will be at CAGRs of 9.8% and 9.2% respectively. These will be followed by Eastern Europe and Asia Pacific, where the markets are expected to grow at CAGRs of 8.1% and 7.0% respectively.

Water and Sewage Market Competitive Landscape

Major Competitors are:

Veolia Environment SA

Suez Environnement SA

Engie

Huaneng Power International, Inc

Companhia de Saneamento Basico-Sabesp

Other Competitors Include:

American Water Works Company, Inc.

United Utilities

Severn Trent Plc

Anglian Water

Ecolab Inc

Kurita Water Industries Ltd

Pt. Amrita Enviro Energi (Banten, Indonesia)

Aquatech International LLC (India)

Toplea Machinery Imp And. Exp Co., Ltd

Shanghai Kaiquan Pump (Group) Co., LTD

Water Corporation

Anbit Drilling Equipment Co., Ltd

Henan Zhong An Electronic Detection Technology CO., LTD

Jiangsu Jiuwu Hi-tech Co

Xi an QingYun Water Treatment Tech. Co., Ltd

GSD Industrial Co., Ltd

Shanghai Dazhang Filtrate Equipment Co.,Ltd

V? ???h W?b?g

?h?rm?? ?nd??

Toshiba water solutions Pvt. Ltd

NALCO (National Aluminium Company Limited)

Thames Water

EUROWATER

Feralco Group

Berliner Wasserbetriebe

NCH Europe

Kemira

ClearFox

Lamor

Lifasa

Nuova Fima SpA

Elecnor

Dellmeco

OSMO Membrane Systems GmbH

Veolia Water Technologies

ASIO spol. s r.o

BWT Poland Sp. o.o

Orenco Systems (Oregon, The U.S.)

Danaher

Aquatech

Xylem Inc (U.S.)

Dow Water And Process Solutions (U.S.)

Calgon Carbon Corporation

Evoqua Water Technologies Corporation (U.S.)

3M (U.S.)

Pentair Plc (U.S.)

ITT Inc. (U.S.)

DuPont (Delaware, United States)

GE Water And Process Technologies

UVDynamics Inc

JPS Industries

Les Traitements Bio-Bac Inc

Dynamix Agitators Inc

Ostara Nutrient Recovery Technologies Inc

Aqua One Filtration Inc

Membrane Specialists LLC

Ground Effects Environmental Services Inc

Atlantech - Model HR MACRO - Flotation System

Alexandria Water Company (AWCO)

Oman Water and Wastewater Services Company

Suido Kiko Middle East (SKME)

Proxa

WEC Projects

Lektratek Water Technology

Water Purification chemical Plant

Water Icon