Electronic Medical Records Market Definition

Electronic medical records (EMRs) are digital versions of paper-based patient records used by healthcare providers to store, manage and share patient health information. EMRs contain medical history, diagnoses, medications, treatment plans, immunization dates, allergies, radiology images and laboratory test results.

The electronic medical records market consists of sales, by entities (organizations, sole traders, or partnerships), of electronic medical records are primarily used by hospitals, clinics, physician practices and other healthcare facilities to enhance the efficiency and accuracy of patient care. EMRs help healthcare providers track patient data over time, identify patients due for preventive screenings, monitor treatment progress and improve overall healthcare decision-making.

All citations copied!

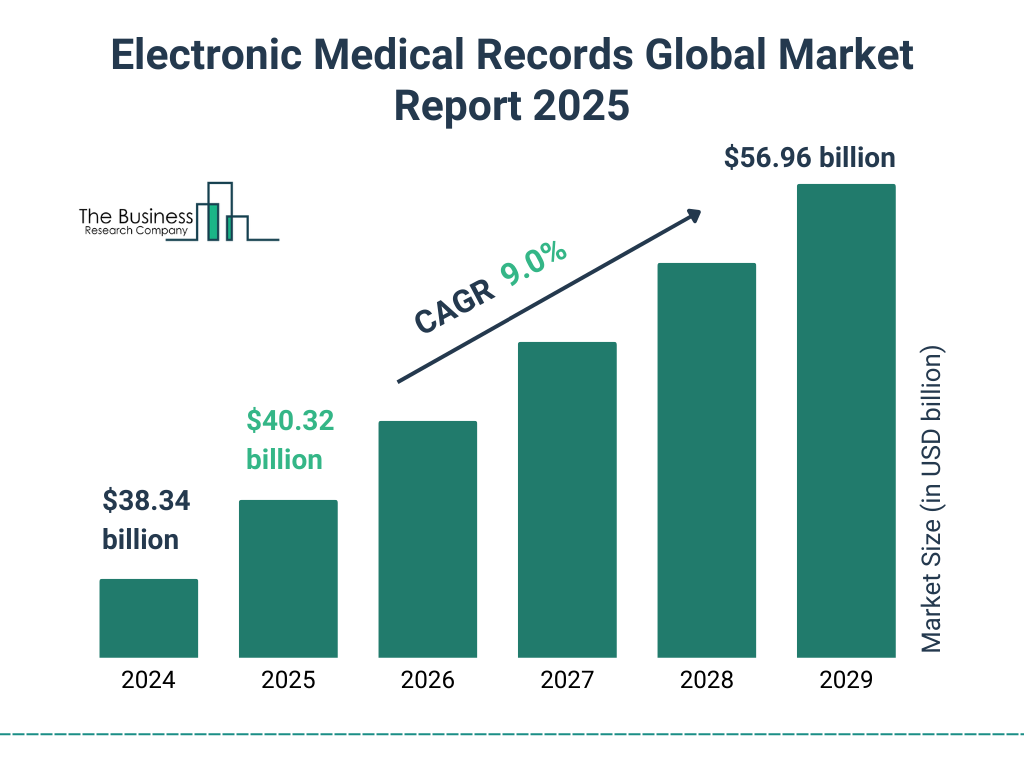

Electronic Medical Records Market Size

The global electronic medical records market reached a value of nearly $38,338.94 million in 2024, having grown at a compound annual growth rate (CAGR) of 6.83% since 2019. The market is expected to grow from $38,338.94 million in 2024 to $52,275.23 million in 2029 at a rate of 6.40%. The market is then expected to grow at a CAGR of 6.00% from 2029 and reach $69,967.62 million in 2034.

Growth in the historic period resulted from favorable government support, shift toward personalized medicine, growth in healthcare infrastructure and increasing medical tourism. Factors that negatively affected growth in the historic period were the high costs of EMR systems and reluctance to adopt new technology in patients.

Going forward, the increasing prevalence of chronic diseases, rising healthcare spending, expansion of telehealth services and increasing digital transformation in healthcare support will drive growth. Factors that could hinder the growth of the electronic medical records market in the future include were limited availability of skilled professionals and inadequate IT infrastructure.

Electronic Medical Records Market Drivers

The key drivers of the electronic medical records market include:

Expansion of Telehealth Services

During the forecast period, the expansion of telehealth services will propel the growth of the electronic medical records market. The expansion of telehealth services is poised to significantly propel the growth of the electronic medical records (EMR), as healthcare providers increasingly adopt digital platforms for remote patient care. The need for robust, secure and efficient systems to store, access and share patient data becomes paramount. As more healthcare systems adopt telemedicine, the integration of EMRs becomes crucial for seamless communication and enhanced patient care. For instance, in February 2025, according to Cross River Therapy, a US-based personal care team, the telehealth industry is projected to reach a market value of $194.1 billion by 2023 and $459.8 billion by 2030. Therefore, the expansion of telehealth services is expected to drive the growth of the electronic medical records market.

Electronic Medical Records Market Restraints

The key restraints on the electronic medical records market include:

Limited Availability Of Skilled Professionals

The limited availability of skilled professionals is expected to hamper the growth of the electronic medical records market during the forecast period. The implementation and management of electronic medical records (EMR) systems require specialized expertise and skilled professionals. However, the ongoing shortage of qualified personnel presents a significant challenge for organizations in recruiting and retaining the necessary talent to effectively operate these complex systems. This lack of skilled professionals can result in slower adoption rates, operational inefficiencies and ultimately impede the growth of the market. For instance, in March 2024, according to the Association of American Medical Colleges, a US-based medication company, by 2036, the United States is projected to experience a shortage of as many as 86,000 physicians. Therefore, the limited availability of skilled professionals is expected to hinder the growth of the electronic medical records market during the forecast period.

Electronic Medical Records Market Trends

Major trends shaping the electronic medical records market include:

New Health Records Feature Brings Seamless Access To Prescriptions And Lab Results

Leading companies in the electronic medical records market are prioritizing the development of advanced health record features to provide seamless access to prescriptions and lab results. A key innovation is a secure health locker that stores personal health data, ensuring it remains protected and accessible only to the user. This solution adheres to the highest standards of privacy and security, safeguarding sensitive medical information. For instance, in January 2025, Samsung, a South Korea-based consumer electronics corporation, launched the Health Records feature on its Samsung Health app in India, in alignment with the government's Ayushman Bharat Digital Mission (ABDM). This new feature enables users to create and access their Ayushman Bharat Health Account (ABHA) directly within the app, providing a secure platform for managing health data such as prescriptions, lab results and hospital visits, all linked to their ABHA ID. Users can register using their Aadhaar or mobile number and access a secure health locker. Additionally, the feature streamlines outpatient services by allowing users to generate virtual queue tokens through QR code scanning at ABDM-compliant hospitals.

Transforming Clinical Efficiency With Cloud-Based EHR Technology

Companies operating in the electronic medical records market are transforming clinical efficiency with cloud-based electronic health record EHR technology. This cloud-based approach allows seamless access to patient data across different locations and devices. It enhances data interoperability, making it easier for hospitals, clinics and healthcare providers to share information. For instance, in November 2024, Oracle, a US-based computer software company, unveiled its next-generation electronic health record (EHR) system at the Oracle Health Summit. This new EHR is built on Oracle cloud infrastructure and integrates AI capabilities across the clinical workflow to automate processes and enhance care delivery. It features conversational search, voice-driven navigation and AI-supported summaries to streamline physician workflows. The system also includes Oracle Health Data Intelligence, which integrates patient data from multiple sources to provide real-time insights and support personalized care plans.

Opportunities And Recommendations In The Electronic Medical Records Market

Opportunities – The top opportunities in the electronic medical records market segmented by type will arise in the ambulatory segment, which will gain $7,624.10 million of global annual sales by 2029. The top opportunities in the electronic medical records market segmented by product will arise in the web-based EHR segment, which will gain $9,454.20 million of global annual sales by 2029. The top opportunities in the electronic medical records market segmented by mode of delivery will arise in the cloud-based model segment, which will gain $10,225.24 million of global annual sales by 2029. The top opportunities in the electronic medical records market segmented by business models will arise in the subscriptions segment, which will gain $6,488.13 million of global annual sales by 2029. The top opportunities in the electronic medical records market segmented by application will arise in the practice management segment, which will gain $3,636.36 million of global annual sales by 2029. The electronic medical records market size will gain the most in the USA at $4,626.68 million.

Recommendations- To take advantage of the opportunities, The Business Research Company recommends the electronic medical records companies to focus on enhancing secure digital health record access, focus on enhancing clinical efficiency through cloud-based EHR integration, focus on cloud-native EHR platforms for underserved healthcare providers, focus on expanding integrated EMR platforms across healthcare networks, focus on integrating cloud-based features to improve healthcare efficiency, focus on the ambulatory segment to capture high-growth opportunities, expand in emerging markets, continue to focus on developed markets, focus on expanding access through strategic partnerships and localized digital platforms, focus on value-based tiered pricing to maximize adoption across healthcare segments, focus on personalized digital outreach to healthcare providers, focus on strategic partnerships and referral programs and focus on training healthcare staff and supporting clinical workflows.

Electronic Medical Records Market Segmentation

The electronic medical records market is segmented by type, by product, by mode of delivery, by business models and by application.

By Type –

The electronic medical records market is segmented by type into:

- a) Acute

- b) Ambulatory

- c) Post-Acute

The acute market was the largest segment of the electronic medical records market segmented by type, accounting for 45.82% or $17,567.86 million of the total in 2024. Going forward, the ambulatory segment is expected to be the fastest growing segment in the electronic medical records market segmented by type, at a CAGR of 8.63% during 2024-2029.

By Product –

The electronic medical records market is segmented by product into:

- a) Client-Server-Based EHR

- b) Web-Based EHR

The client-server-based EHR market was the largest segment of the electronic medical records market segmented by product, accounting for 56.27% or $21,571.48 million of the total in 2024. Going forward, the client-server-based EHR segment is expected to be the fastest growing segment in the electronic medical records market segmented by product, at a CAGR of 7.54% during 2024-2029.

By Mode Of Delivery –

The electronic medical records market is segmented by mode of delivery into:

- a) Cloud-Based Model

- b) On-Premise Model

The cloud-based model market was the largest segment of the electronic medical records market segmented by mode of delivery, accounting for 60.28% or $23,110.29 million of the total in 2024. Going forward, the cloud-based model segment is expected to be the fastest growing segment in the electronic medical records market segmented by mode of delivery, at a CAGR of 7.60% during 2024-2029.

By Business Models –

The electronic medical records market is segmented by business models into:

- a) Licensed Software

- b) Technology Resale

- c) Subscriptions

- d) Professional Services

- e) Managed Services

- f) Other Business Models

The licensed software market was the largest segment of the electronic medical records market segmented by business models, accounting for 38.20% or $14,645.47 million of the total in 2024. Going forward, the subscriptions segment is expected to be the fastest growing segment in the electronic medical records market segmented by business models, at a CAGR of 11.00% during 2024-2029.

By Application –

The electronic medical records market is segmented by application into:

- a) E-Prescription

- b) Practice Management

- c) Referral Management

- d) Patient Management

- e) Population Health Management

- f) Other Applications

The practice management market was the largest segment of the electronic medical records market segmented by application, accounting for 27.20% or $10,428.19 million of the total in 2024. Going forward, the e-prescription segment is expected to be the fastest growing segment in the electronic medical records market segmented by application, at a CAGR of 8.12% during 2024-2029.

By Geography - The electronic medical records market is segmented by geography into:

o Asia Pacific

- • China

- • India

- • Japan

- • Australia

- • Indonesia

- • South Korea

o North America

o South America

o Western Europe

- • France

- • Germany

- • UK

- • Italy

- • Spain

o Eastern Europe

o Middle East

o Africa

North America was the largest region in the electronic medical records market, accounting for 38.61% or $14,802.78 million of the total in 2024. It was followed by Western Europe, Asia-Pacific and then the other regions. Going forward, the fastest-growing regions in the electronic medical records market will be Asia-Pacific and South America where growth will be at CAGRs of 7.99% and 7.92% respectively. These will be followed by Western Europe and Eastern Europe where the markets are expected to grow at CAGRs of 6.34% and 6.29% respectively.

Electronic Medical Records Market Competitive Landscape

Major Competitors are:

Epic Systems Corporation Oracle (Cerner Corporation) MEDITECH (Medical Information Technology Inc) CompuGroup Medical SE & Co. KGaA. NextGen Healthcare LLC Other Competitors Include:

eClinicalWorks Inc. InterSystems Corporation Philips (Tasy EMR) GE Healthcare Henry Schein Medical Systems Inc. Infomed Vietnam Honeywell Lifesciences Philips Healthcare McKesson Corporation Oracle Health Huawei Technologies Co., Ltd Innovaccer Pharm Easy Practo Mfine Medi Buddy JD Health Chamonix China Mobile Hong Kong Company Limited China Mobile Limited Heals Healthcare Intelligentdx Pvt Ltd Samsung India Wemex Corporation Fujitsu Limited Sapporo Medical University Medical Data Vision Co., Ltd. LG Healthcare Telstra Health Pty Ltd Hyland Software Greenway Health China Medical University Hospital (CMUH) Vascue Ultra High Point Limited Mindray Medical International Limited Medidata Solutions Japan's Mitla Co., Ltd NEC Corporation NTT DATA Group Samsung Medical Center Inha University Hospital Philips Korea Better Doc Biovotion BrainControl Coimbra Genomics Dacadoo Doctoralia Emperra Exovite Healthbank NeurNation Nutrino Px Healthcare SilverCloud Enovacom Medanets Oy Ayesa Chipsoft B.V. CompuGroup Medical 1C Company GE Poland McKesson Europe Honeywell Healthcare Veradigm Inc. AutoCruitment Oracle WELL Health Technologies Corp. MEDFAR Clinical Solutions Biofile HealthPlix Medicon Red Hat Tasy Cerner Corporation Veradigm Wipro Limited Royal Philips CloudPital MedicoPlus Etisalat Clinicea Aster DM Healthcare Burjeel Hospitals Ajir Ltd. MEDITECH South Africa Allgeier

Author :

Abdul Wasay

Electronic Medical Records Market Size

The global electronic medical records market size grew from $22,228.2 million in 2016 to $31,775.2 million in 2021 at a compound annual growth rate (CAGR) of 7.4%. The global electronic medical records market size is expected to grow from $31,775.2 million in 2021 to $44,179.6 million in 2026 at a CAGR of 6.8%, and to $65,936 million in 2031 at a CAGR of 8.3%.

Growth in the historic period resulted from the growth in healthcare information technology, increased government initiatives, increased demand for digital transformation in healthcare and COVID-19 outbreak.

Going forward, the technological developments, a surge in the number of health diseases, increasing healthcare expenditure and faster economic growth will drive the market growth. Factors that could hinder the growth of the electronic medical records market in the future include data safety issues and the Russia-Ukraine war.

Electronic Medical Records Market Drivers

The key drivers of the electronic medical records market include:

Surge In The Number Of Health Diseases

Rising health diseases globally are expected to propel the growth of the electronic medical records market in the forecast period. Health diseases are increasing due to weather changes, rapid urbanization, changing land-use patterns, infections, heredity and other reasons. The increasing prevalence of diseases will lead to an increase in the number of patients, supporting the demand for medical record keeping, including EMRs. Due to the ever-increasing loads of healthcare documents and information, there will be a need for an effective tool for keeping records, making the electronic medical record one of the most effective and efficient tools to store, access, retrieve and protect patient health records, while also helping in preventive care. According to the International Agency for Research on Cancer (IARC), an intergovernmental agency and part of WHO (World Health Organization), the number of new cancer cases is estimated to reach 26 million and of cancer deaths is projected to reach 17 million per year by 2030. Therefore, the rising number of health diseases will fuel the growth of the electronic medical records market.

Electronic Medical Records Market Restraints

The key restraints on the electronic medical records market include:

Data Safety Issues

The data safety issues and challenges with respect to EMRs are expected to hamper the growth of the electronic medical records market during the forecast period. Electronic medical records are associated with several privacy and security issues, such as patients’ data and safety. Moreover, cybercrime is increasing globally, which poses a significant challenge to electronic medical records. Cybercrime is rising due to the increasing automation, rapid use of the internet, remote working and others. The vulnerability of electronic records over the internet will increase the risks associated with the use of electronic medical records. For example, according to Cybersecurity Ventures, a global publisher covering the global cyber economy, by 2025, cybercrime is expected to cost the world $10.5 trillion annually. Therefore, the data safety issues of EMRs are expected to hinder the growth of the electronic medical records market during the forecast period.

Electronic Medical Records Market Trends

Major trends influencing the electronic medical records market include:

Use Of Artificial Intelligence

Artificial intelligence (AI) is gaining traction in the electronic medical records market. Artificial intelligence is widely used in EHRs (Electronic Health Records) to enhance data search, extraction and individualized treatment recommendations. For example, in August 2022, TidalHealth, a Maryland, US-based health system of hospitals, health campuses, physician and specialty offices, collaborated with Regard, a Los Angeles, US-based software company, to launch AI-based software to increase patient diagnostic accuracy, lessen physician exhaustion and boost revenue. The software employs AI to assist doctors in making a medical diagnosis and assists practitioners in streamlining EHR chart checks and improving patient safety.

Adoption Of Natural Language Processing

The adoption of Natural Language Processing (NLP) is a key trend in the electronic medical records market. NLP creates machines that can comprehend text or voice input and react to it as people do by responding with text or speech of their own. NLP techniques are used in EHRs to capture unstructured data, analyze the grammatical structure, determine the meaning and summarize the data. As a result, NLP approaches can cut costs, while thoroughly extracting large amounts of data analytics information. For instance, in September 2022, Edifecs, Inc., a US-based healthcare technology company, launched a technology that completely automates prior authorization at the point of care, resulting in better member experiences, improved results, continuous compliance and less administrative work. The automated prior permission solution from Edifecs interacts with EHRs and instantaneously provides authorization using NLP and AI.

Opportunities And Recommendations In The Electronic Medical Records Market

Opportunities –The top opportunities in the electronic medical records market by type will arise in the acute segment, which will gain $5,706.8 million of global annual sales by 2026. The top opportunities in the electronic medical records market by product will arise in the web-based EHR segment, which will gain $7,516.8 million of global annual sales by 2026. The top opportunities in the electronic medical records market by mode of delivery will arise in the cloud-based model segment, which will gain $10,141.6 million of global annual sales by 2026. The top opportunities in the electronic medical records market by business models will arise in the professional services segment, which will gain $5,335.3 million of global annual sales by 2026. The top opportunities in the electronic medical records market by application will arise in the practice management segment, which will gain $3,521.8 million of global annual sales by 2026. The electronic medical records market size will gain the most in the USA at $4,139.9 million.

Recommendations-To take advantage of the opportunities, The Business Research Company recommends the companies in the electronic medical records market to focus on use of artificial intelligence, focus on natural language processing, focus on cloud-based EHRs (electronic health records), focus on voice assistance, expand in emerging markets, continue to focus on developed markets, focus on strategic partnerships, offer competitive pricing, participate in trade shows and events and continue to target fast-growing applications.

Electronic Medical Records Market Segmentation

The electronic medical records market is also segmented by type, by product, by mode of delivery, by business models, and by application.

By Type-

The electronic medical records market is segmented by type into

- a) Acute

- b) Ambulatory

- c) Post-Acute

The acute market was the largest segment of the electronic medical records market segmented by type, accounting for 47.8% of the total in 2021. Going forward, the ambulatory market is expected to be the fastest growing segment in the electronic medical records market segmented by type, at a CAGR of 7.2% during 2021-2026.

By Product-

The electronic medical records market is segmented by product into

- a) Client-Server-Based HER

- b) Web-Based HER

The web-based EHR market was the largest segment of the electronic medical records market segmented by product, accounting for 55.2% of the total in 2021. Going forward, the web-based EHR market is expected to be the fastest growing segment in the electronic medical records market segmented by product, at a CAGR of 7.4% during 2021-2026.

By Mode Of Delivery-

The electronic medical records market is segmented by mode of delivery into

- a) Cloud-Based Model

- b) On-Premise Model

The cloud-based model market was the largest segment of the electronic medical records market segmented by mode of delivery, accounting for 70.3% of the total in 2021. Going forward, the cloud-based model market is expected to be the fastest growing segment in the electronic medical records market segmented by mode of delivery, at a CAGR of 7.8% during 2021-2026.

By Business Models-

The electronic medical records market is segmented by business models into

- a) Licensed Software

- b) Technology Resale

- c) Subscriptions

- d) Professional Services

- e) Managed Services

- f) Other Business Models

The professional services market was the largest segment of the electronic medical records market segmented by business models, accounting for 35.8% of the total in 2021. Going forward, the professional services market is expected to be the fastest growing segment in the electronic medical records market segmented by business models, at a CAGR of 8.0% during 2021-2026.

By Application

The electronic medical records market is segmented by application into

- a) E-Prescription

- b) Practice Management

- c) Referral Management

- d) Patient Management

- e) Population Health Management

- f) Other Applications

The practice management market was the largest segment of the electronic medical records market segmented by application, accounting for 30.3% of the total in 2021. Going forward, the e-prescription market is expected to be the fastest growing segment in the electronic medical records market segmented by application, at a CAGR of 8.0% during 2021-2026.

By Geography - The electronic medical records market is segmented by geography into

o Asia Pacific

- • China

- • India

- • Japan

- • Australia

- • Indonesia

- • South Korea

o North America

o South America

o Western Europe

o Eastern Europe

o Middle East

o Africa

North America was the largest region in the electronic medical records market, accounting for 39.1% of the total in 2022. It was followed by Western Europe, and then the other regions. Going forward, the fastest-growing regions in the electronic medical records market will be Asia Pacific and South America, where growth will be at CAGRs of 8.4% and 8.4% respectively. These will be followed by the Middle East and Western Europe, where the markets are expected to grow at CAGRs of 7.1% and 6.9% respectively.

Electronic Medical Records Market Competitive Landscape

Major Competitors are:

Cerner Corporation

Allscripts Healthcare Solutions, Inc

General Electric Company

Athenahealth

NextGen Healthcare, Inc

Other Competitors Include:

Epic Systems Corp

eClinicalWorks

CPSI

Intersystems Corporation

AdvancedMD, Inc

Innovaccer

Pharm Easy

1mg

Practo

Mfine

Medi Buddy

Indegene

Ping A Good Doctor

JD Health

CISCO Systems Inc

GE Healthcare

Honeywell Lifesciences

Philips Healthcare

Better Doc

Biovotion

BrainControl

Coimbra Genomics

Dacadoo

Doctoralia

Emperra

Exovite

Genexyx

Giraff

Healthbank

NeurNation

Nutrino

Psious

Px Healthcare

SilverCloud

Systems Healthcare Solutions

TrialReach

XtremeVRI

TietoEVRY

DOC+

McKesson Corporation

Medical Information Technology, Inc

Health Information Management Systems

Computer Programs and Systems, Inc CPSI

CureMD Healthcare

Greenway Health,LLC

WELL Health Technologies Corp

Indivica Inc

OSCARwest

MV Sistemas

Philips-Tasy

Siemens

R.R. Information Systems and Technologies Ltd

Mubadala Health

G42 Healthcare

Etisalat

Vezeeta

OKADOC

Doxy.me

Safermom

Mobicure

Ubenwa

Medsaf

GenRx

MDaaS Global

Kangpe

Hudibia

Lifebank

Redbank

AMD Global Telemedicine Inc

Medtronic PLC