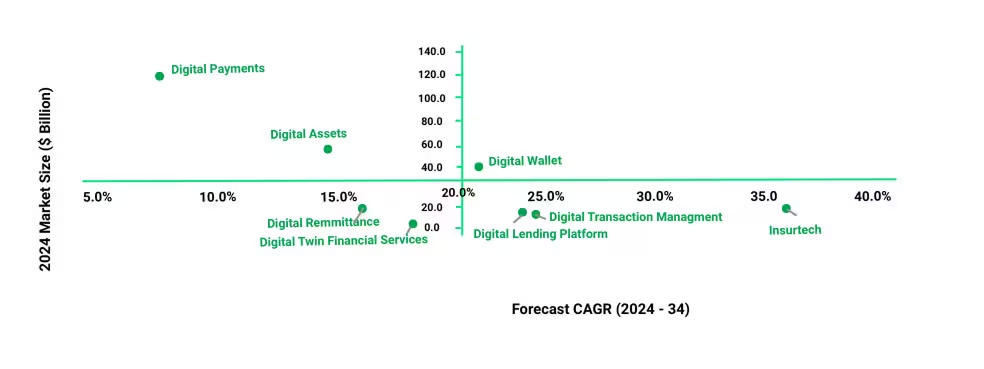

Financial technology is evolving rapidly, transforming how individuals and institutions manage, move, and protect money. From digital payments and wallets to insurtech and lending platforms, FinTech innovations are modernizing traditional financial services and creating new user experiences. Global Market Model analyzed key FinTech segments to understand current market sizes in 2024 and growth expectations through 2034.

Reports Store

Top 50 Healthcare Market Reports

NEW

Top 50 Non-Healthcare Market Reports NEW

Opportunities And Strategies Reports

Aerospace And Defense

Agriculture

Chemicals

Construction

Electrical And Electronics

Financial Services

Food And Beverages

Healthcare Services

Hospitality

Information Technology

Machinery

Media