1. Electric Vehicles and EV Batteries

Why the category matters: EVs and batteries represent a transformative shift in personal transport and energy storage. Consumers across APAC are switching from internal combustion engines to battery‑powered vehicles, attracted by lower running costs, environmental benefits and government incentives. EV batteries are not only used in cars but also power scooters, bikes and household devices.

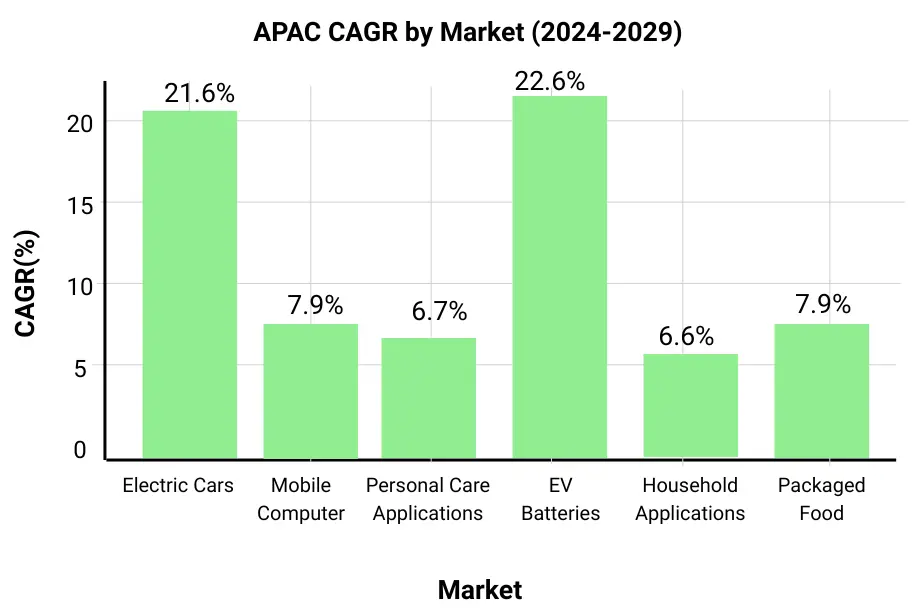

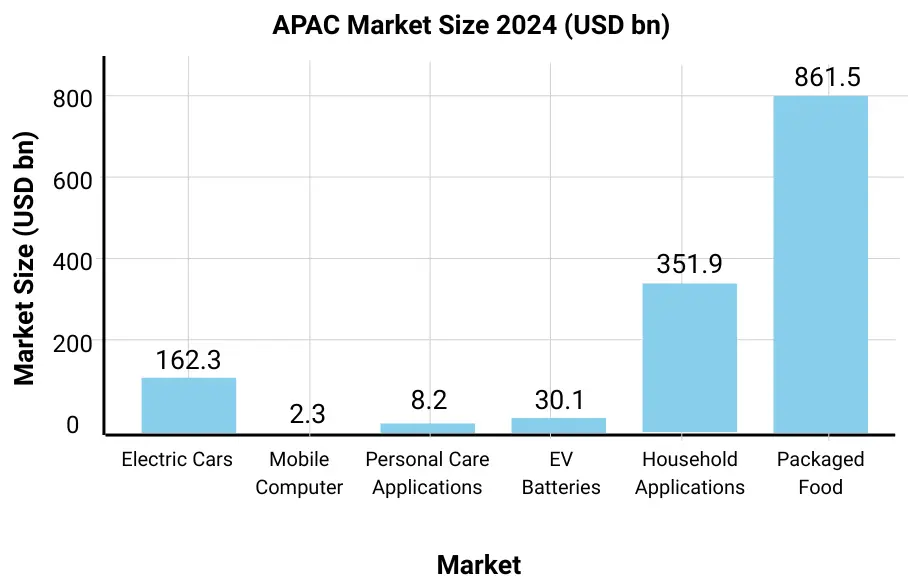

Market scale and growth: In APAC, electric cars generated $ 162.3 billion in 2024 and will expand at 21.6% CAGR to 2029. EV batteries, valued at $ 30.1 billion in 2024, will grow even faster at 22.6%. The Business Research Company’s EV batteries report identifies Asia‑Pacific as the largest region in 2024 and projects the global market to grow from $ 67.13 billion in 2024 to $ 196.62 billion in 2029 (22.1% CAGR). This growth is supported by surging vehicle sales, declining battery costs and supportive policies such as India’s Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme and China’s extension of EV subsidies.

Supply‑chain realignment and affordability: Tariff-driven supply‑chain changes have made EVs more accessible. Companies relocated battery assembly and cell production to countries with favorable trade terms, such as Vietnam, Thailand and India. Some producers redesigned battery chemistry to reduce reliance on cobalt or nickel, which were targeted by tariffs. As a result, battery pack costs fell, preventing a potential 3-5% price increase. This cost relief trickles down to consumers through lower vehicle prices or extended driving ranges.

Country insights:

- India: India’s EV market is still nascent but growing explosively. The government’s FAME incentives lower purchase prices, while state policies (e.g., Delhi’s EV policy) support charging infrastructure. Indian consumers also show strong interest in electric two‑wheelers and three‑wheelers, which offer affordable transport in crowded cities. With domestic battery manufacturing gaining traction (e.g., partnerships between global battery firms and Indian conglomerates), costs will fall further.

- Indonesia: Indonesia is rapidly developing a battery supply chain thanks to its abundant nickel reserves. Government policies require a certain percentage of local content in EV production, pushing manufacturers to assemble vehicles locally and source batteries domestically. New investments from South Korean, Chinese and European firms aim to build integrated battery and EV plants, fueling consumption growth.

- China: China is the world’s largest EV market, but its growth rate slows from a high base. Nevertheless, domestic battery giants are exporting to Southeast Asian markets, reducing costs for consumers in those countries. Innovations in battery technology, such as solid‑state and sodium‑ion batteries, promise further cost reductions and better safety.

- Vietnam and Thailand: Though not in the top‑four dataset, Vietnam and Thailand are building EV manufacturing ecosystems. VinFast in Vietnam and Thai government initiatives attract investment from global automakers. Consumers in these markets are early adopters of EVs, especially e‑scooters and compact cars.

2. Smartphones and Mobile Computers

Why the category matters: Smartphones and tablets are essential to modern life, connecting consumers to shopping, entertainment, banking and education. APAC is home to the world’s largest smartphone user base; mobile devices often serve as the primary internet gateway. Growth in this category reflects not only hardware sales but also the expansion of digital ecosystems.

Market scale and growth: The Global Market Model dataset shows that mobile computers (used here as a proxy for smartphones and tablets) generated US$2.3 billion in APAC in 2024 and are expected to grow at 7.9% CAGR. While this figure seems small relative to the global smartphone industry, it represents the incremental consumption captured in the Global Market Model data for our selected markets. Given the absence of a dedicated The Business Research Company’s report for smartphones, we rely solely on the Global Market Model data and general observations. The smartphone market overall is mature but still expanding as consumers upgrade to 5G devices, adopt AI‑capable handsets and integrate phones into smart‑home ecosystems.

Supply‑chain realignment and affordability: Smartphone manufacturers were among the earliest to shift assembly from China to Southeast Asia due to trade tensions. Companies like Samsung and Apple have expanded production in Vietnam, India and Indonesia to circumvent tariffs and diversify risk. These moves have boosted local employment and allowed governments to incentivize domestic component manufacturing (e.g., India’s Production-Linked Incentive scheme). Cheaper labor and improved logistics reduce production costs, and local manufacturing often qualifies for tax breaks, leading to more affordable devices.

Country and sub‑region insights:

- India: India has become a major smartphone manufacturing hub. Local production reduces import duties, allowing companies to offer feature-rich devices at competitive prices. Indian consumers also upgrade frequently as 5G networks roll out across the country. Growth will continue as rural areas connect to high-speed networks and as smartphone financing becomes more accessible.

- Indonesia and Vietnam: Both countries are major beneficiaries of supply‑chain shifts. Consumers in Indonesia buy mid-range devices for entertainment, payment and education, while Vietnam has a high smartphone penetration and exports to other ASEAN countries. The presence of local assembly means faster product launches and local customization.

- Philippines, Thailand and Malaysia: These markets have young populations and high social-media engagement. As tariffs encouraged assembly plants to move closer to Southeast Asia, smartphone prices have become more competitive, enabling consumers to upgrade more often. While quantitative data is limited in the Global Market Model dataset, anecdotal evidence suggests that smartphone consumption is rising in these countries.

The 7.9% CAGR from the Global Market Model data suggests a steady yet moderate expansion, reflecting a maturing market with regular upgrade cycles rather than explosive growth.

3. Packaged Food

Why the category matters: Packaged food encompasses everything from ready‑to‑eat meals and snacks to frozen and canned goods. In APAC, changing lifestyles, urbanization and rising incomes are driving consumers toward convenient meal options. E‑commerce and modern retail channels enable rapid distribution.

Market scale and growth: According to The Business Research Company’s packaged food report, the global packaged food market is expected to grow from $ 3,119.12 billion in 2024 to $ 4,250.13 billion in 2029 at a 6.7% CAGR. The report highlights that Asia‑Pacific is a major contributor to this growth. In the Global Market Model data, packaged food in APAC is the largest of the six markets at $ 861.5 billion, growing at 7.9%. This indicates that consumption growth in APAC slightly outpaces the global average.

Drivers and supply‑chain dynamics: Several factors fuel packaged food consumption:

- Sustainable packaging and innovation: Producers are investing in recyclable and biodegradable packaging solutions to meet consumer demand for eco‑friendly products. Innovations like Koehler NexPure OGR, a barrier paper that protects oily and greasy food, demonstrate progress in sustainable packaging.

- Health and wellness: Consumers seek healthier snacks and meal options, prompting companies to reformulate products with lower sugar, salt and fat. Premiumisation—offering higher-quality or organic products—resonates with the rising middle class.

- E‑commerce and quick commerce: The growth of online grocery platforms accelerates packaged food sales. The Business Research Company notes that increasing demand for e‑commerce and quick delivery services is a significant driver.

- Impact of tariffs: Tariffs on imported ingredients raised grocery prices and could have slowed growth. To mitigate this, companies have strengthened local sourcing and invested in supply-chain technology. Many retailers hold larger inventories or sign long‑term contracts to avoid spot market volatility.

Country and sub‑region insights:

- India: The Indian packaged food market is expanding due to a young population with increasing disposable income, more women participating in the workforce and growing demand for convenience. Regional brands compete with multinational players, offering products tailored to local tastes.

- Indonesia: Indonesia’s large population and rising middle class drive strong demand for noodles, snacks and ready‑to‑eat meals. E‑commerce marketplaces like Tokopedia and Shopee accelerate distribution.

- China: China remains the largest single market for packaged food in APAC. Consumers are increasingly health‑conscious and are willing to pay more for high‑quality ingredients and functional foods (e.g., probiotics). Companies invest heavily in cold-chain logistics to serve a vast geography.

- Philippines and Vietnam: Both countries have youthful demographics and high snack consumption. Imports play a role, but local producers have gained share by adapting flavors and packaging to local preferences.

4. Personal Care Appliances

Why the category matters: Personal care appliances include hair dryers, electric shavers, epilators and electric toothbrushes. They cater to consumers’ desire for grooming, wellness and convenience. The category is influenced by beauty trends, technological innovation and digital retail.

Market scale and growth: The Business Research Company reports that the global personal care appliances market grew from $ 22.37 billion in 2024 to $ 23.39 billion in 2025 and will reach $ 29.85 billion in 2029, a 6.3% CAGR. The Global Market Model data show that personal care appliances in APAC generated $ 8.2 billion in 2024 and will grow at 6.7%. The market’s smaller size relative to packaged food or household appliances underscores its niche nature but steady growth.

Drivers and supply‑chain dynamics:

- Smart appliances: Many appliances incorporate sensors, app connectivity and customization features. This adds value and encourages upgrades.

- Beauty and wellness trends: Changing lifestyles and greater emphasis on personal grooming drive demand. The Business Research Company notes that personal care routines have become important for 72% of European consumers, signalling a similar trend globally. Consumers in Asia are spending more on personal appearance, particularly young professionals and social-media influencers.

- E‑commerce growth: Online platforms allow consumers to compare features and prices easily. The Business Research Company highlights e‑commerce as a key driver for personal care appliances.

- Tariff impacts: Tariffs have increased costs for ceramic heating elements, lithium batteries and other components. As a result, some brands increased prices or shifted production to tariff‑friendly countries. However, supply‑chain diversification and local assembly in countries such as Malaysia and Thailand are helping mitigate cost pressures.

Country and sub‑region insights:

- South Korea: South Korea is a trendsetter in beauty and grooming, with consumers adopting new appliances quickly. Local brands innovate with skin‑care tools and hair‑care devices. The Global Market Model data show steady growth in personal care appliances, and strong export potential to other Asian markets.

- China and Japan: Both markets are sophisticated, with consumers willing to pay for advanced features like ionic technology and AI-driven skin analysis. Tariffs have encouraged some manufacturers to produce certain components domestically.

- Malaysia, Thailand and Vietnam: These countries are emerging markets for personal care appliances. As incomes rise and social norms evolve, more consumers invest in grooming devices. Tariff-driven supply‑chain shifts have encouraged brands to assemble devices locally, lowering prices.

5. Household Appliances

Why the category matters: Household appliances include refrigerators, washing machines, air conditioners and small kitchen gadgets. They are essential for modern living and account for a large share of consumer spending. Growth is driven by urbanization, rising disposable incomes, electrification and housing upgrades.

Market scale and growth: The Business Research Company’s household appliances report indicates that the global market will grow from $ 648.52 billion in 2024 to $ 897.16 billion in 2029, a 6.9% CAGR. According to the Global Market Model dataset, household appliances in APAC generated $ 351.9 billion in 2024 and will grow at 6.6%. This underscores APAC’s significance; the region accounts for more than half of global household appliance consumption.

Drivers and supply‑chain dynamics:

- Home renovation and electrification: The Business Research Company notes that increased home renovation activities and rising focus on energy efficiency are driving the household appliance market. New apartment construction in cities and rural electrification projects stimulate demand.

- Smart and energy‑efficient appliances: Innovations such as AI-powered washing machines and connected refrigerators (able to monitor inventory and order groceries) are becoming mainstream. Manufacturers incorporate LED lighting and sensors to save energy.

- E‑commerce and quick delivery: Like other consumer categories, household appliances are increasingly purchased online. The Business Research Company emphasises that increasing demand for online purchasing is accelerating the market.

- Tariff impacts: Tariffs have increased the cost of raw materials like steel and electronic components. To manage cost pressures, firms shifted production to lower-tariff countries and streamlined supply chains. Local manufacturing in India, Vietnam and Malaysia has expanded significantly, making appliances more affordable.

Country and sub‑region insights:

- India: Housing growth and electrification drive demand for refrigerators, air conditioners and washing machines. Government policies promoting energy-efficient appliances and schemes like “Housing for All” support the market.

- China: As the largest global producer and consumer of household appliances, China influences regional trends. Its appliance giants are investing in smart home ecosystems. However, as the market matures, growth moderates.

- Vietnam, Thailand and the Philippines: These countries are at earlier stages of appliance adoption but are rapidly catching up. Rising incomes allow more households to purchase refrigerators and air conditioners. Suppliers entering these markets emphasise affordable price points and durability.

- Malaysia: Malaysia’s high urbanization rate and government incentives for energy-efficient appliances drive demand. Local assembly plants help keep prices competitive and mitigate tariff impacts.